Revenue and Earnings Estimates for The Indian Hotels Company LimitedRevenue and Earnings Estimates for The Indian Hotels Company Limited Revenue: * Consensus estimate for 2025: ₹79.4 billion * Forecast decline of 25% from the previous year Earnings per Share (EPS) * Consensus estimate for 2025: ₹11.30 * Forecast decline of 52% from the previous year Analysts’ Views: * No significant changes in revenue or EPS estimates after the release of Q1 results * Revenue forecasts imply an underperformance compared to the wider industry * Price target remains unchanged at ₹623, suggesting no major changes in intrinsic value Risks and Warnings: * Revenue growth expected to reverse with an annual decline of 32% through 2025 * Two potential warning signs to be aware of Valuation Complexity: * Fair value estimates, risks, and financial health factors should be considered for a comprehensive valuation Disclaimer: * Analysis provided by Simply Wall St is general in nature and based on historical data and analysts’ forecasts. * It does not constitute financial advice and should not be used as the sole basis for investment decisions. * Simply Wall St holds no position in the mentioned shares.

Investors in The Indian Hotels Company Limited (NSE:INDHOTEL) had a good week as shares rose 4.9% to close at ₹620 after the release of its first-quarter results. Revenues of ₹16b were in line with forecasts, though statutory earnings per share (EPS) came in below expectations at ₹1.75, 7.6% below estimates. The analysts typically update their forecasts with each earnings report, and we can judge from their estimates whether their view of the business has changed or if there are any new concerns to be aware of. With this in mind, we’ve gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Indian hotels

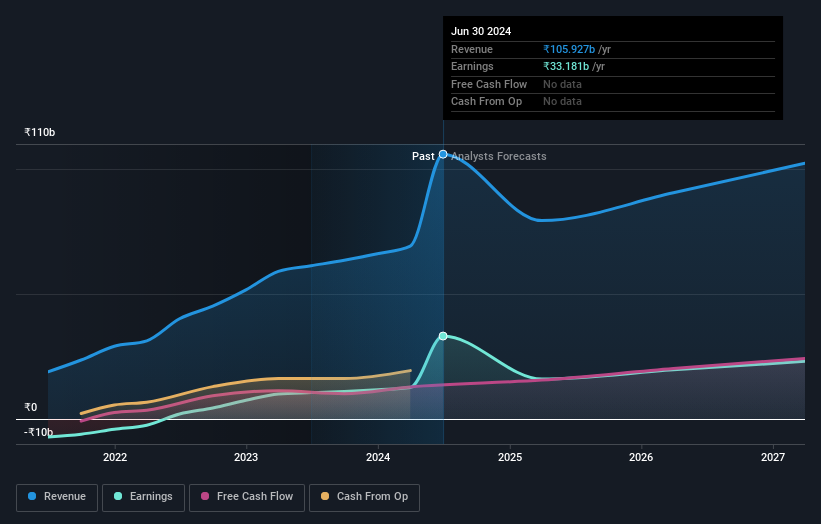

Following the latest results, the consensus from Indian Hotels’ 22 analysts is for revenues of ₹79.4 billion in 2025, which would reflect a worrying 25% decline in revenue compared to the last year of performance. Statutory earnings per share are also expected to fall 52% to ₹11.30 over the same period. In the run-up to this report, the analysts had been modelling revenues of ₹78.1 billion and earnings per share (EPS) of ₹11.49 in 2025. The consensus analysts don’t appear to have seen anything in these results that would change their view of the business, as there has been no major change to their estimates.

The analysts reaffirmed their price target of ₹623, which shows that the company is performing well and in line with expectations. The consensus price target is just an average of individual analyst targets, so it could be useful to see how wide the range of underlying estimates is. The most optimistic Indian Hotels analyst has a price target of ₹715 per share, while the most pessimistic values it at ₹510. Analysts certainly have different opinions on the company, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes await Indian Hotels shareholders.

These estimates are interesting, but it can be useful to paint some broader lines when looking at how forecasts compare to Indian Hotels’ past performance and that of its peers. We’d like to highlight that revenue is expected to turn around, with a forecast annual decline of 32% through to the end of 2025. That’s a notable change from the historical growth of 19% over the past five years. Compare this to our data, which suggests that other companies in the same industry are expected to see revenue grow by 15% per year overall. So while revenue is expected to shrink, there’s no silver lining to this cloud – Indian Hotels is expected to underperform the wider industry.

It comes down to

The most obvious conclusion is that there has been no major change in the company’s outlook recently, with analysts holding their profit forecasts steady, in line with previous estimates. On the positive side, there were no major changes in revenue estimates; although forecasts imply they will underperform the wider industry. There was no real change in the consensus price target, suggesting that the intrinsic value of the company has not changed significantly from the latest estimates.

Following that line of thinking, we believe the long-term outlook for the company is far more relevant than next year’s earnings. We have forecasts for Indian Hotels out to 2027, and you can see them for free on our platform here.

But before you get too excited, here’s what we discovered: 2 Warning Signs for Indian Hotels (1 cannot be ignored!) that you should be aware of.

Valuation is complex, but we make it simple.

Find out if Indian hotels may be over or undervalued by looking at our comprehensive analysis, which includes the following fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the free analysis

Do you have feedback on this article? Are you concerned about the content? Contact Us directly with us. You can also email editorial-team (at) simplywallst.com.

This article from Simply Wall St is general in nature. We comment solely on historical data and analyst forecasts, using an objective methodology. Our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any shares and does not take into account your objectives or financial situation. We aim to provide you with a long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in the shares mentioned.

Valuation is complex, but we make it simple.

Find out if Indian hotels may be over or undervalued by looking at our comprehensive analysis, which includes the following fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the free analysis

Do you have feedback on this article? Are you concerned about the content? Please contact us directly. You can also send an email to [email protected]