Ethereum ETFs Receive Final Approval, Trading Commences TomorrowEthereum ETFs Receive Final Approval, Trading Commences Tomorrow The United States Securities and Exchange Commission has granted final approval for the launch of the first spot Ethereum (ETH) exchange-traded funds (ETFs) in the country. Trading will officially commence on Tuesday, July 23rd. The SEC approved applications from eight issuers, including Fidelity, Blackrock, VanEck, and 21Shares. These issuers have obtained the registration of their securities, allowing them to begin trading their ETH spot ETFs. The SEC initially approved applications for ETH ETFs in May, but companies were required to finalize their S-1 filings (registration for new securities) before trading could commence. Last week, issuers were instructed to complete their S-1 documents by July 17th to ensure approval for trading on July 23rd. Impact on ETH Price Uncertain Analysts believe the impact of spot ETH ETFs on the price of ETH remains uncertain. A report by Kaiko Research suggests demand for futures-based ETH ETFs launched last year was underwhelming. In the past 24 hours, ETH has experienced a 2.5% decline and is currently trading around $3,400. Analysts from IntoTheBlock have identified $3,500 as a critical resistance level for Ethereum. Broader Adoption Expected The launch of spot ETH ETFs is generally seen as a positive sign for the broader adoption of cryptocurrency. ETFs provide access to digital assets through traditional brokerage accounts, making them more accessible to mainstream investors. Bitcoin Precedent Spot Bitcoin (BTC) ETFs were approved for trading in January in the US and have witnessed record inflows. Since their launch, the price of Bitcoin has increased by nearly 50%, currently hovering around $67,700. The approval of spot ETH ETFs marks a significant milestone in the cryptocurrency space and is expected to contribute to the adoption and growth of Ethereum.

The US SEC has given the final go-ahead for the first spot ETH ETFs in the United States. Trading begins tomorrow, July 23.

Today, July 22, the U.S. Securities and Exchange Commission accepted the securities registrations of several Ethereum (ETH) spot exchanges, allowing them to begin trading as scheduled starting Tuesday.

The SEC approved ETH ETF products from a total of eight issuers, including asset managers Fidelity, Blackrock and VanEck, as well as 21Shares, Bitwise and others.

The SEC first approved applications for the above ETH ETFs in late May, but companies were still waiting for approval of their S-1 filings — the registration of new securities — to officially begin trading. Last week, the SEC informed issuers that they must complete their S-1 documents by July 17 in order to receive approval to begin trading on July 23.

How will ETH price react?

A report published today by Kaiko Research suggested that the outlook for ETH’s price following the launch of spot ETFs is unclear. The firm noted that when futures-based ETH ETFs launched last year, demand was “subpar.”

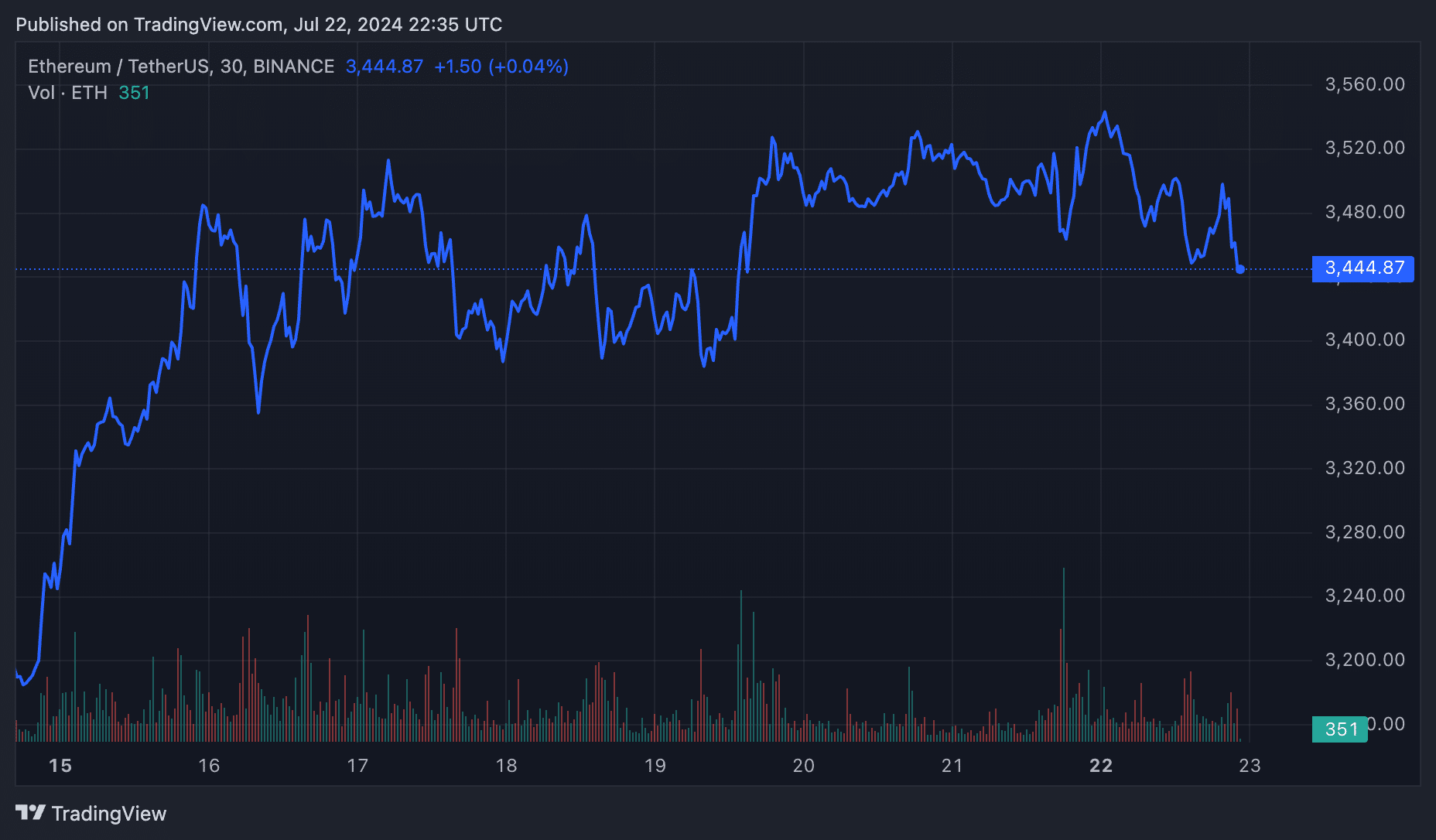

ETH price has dropped by around 2.5% over the past 24 hours and is currently trading around $3,400. Earlier today, analysts at IntoTheBlock noted that Ethereum price is facing critical resistance around the $3,500 levels.

30-Minute ETH Price Chart, July 15-22, 2024 | Source: crypto.news

30-Minute ETH Price Chart, July 15-22, 2024 | Source: crypto.news

Overall, as with spot Bitcoin (BTC) ETFs, analysts — and the industry at large — see the launch of a spot ETF product as a bullish sign for broader adoption. Because ETFs trade on traditional exchanges through brokerage accounts, a broader group of more traditional investors now have access to the two largest cryptocurrencies by market cap through a vehicle they are already comfortable trading.

First Bitcoin, now Ethereum

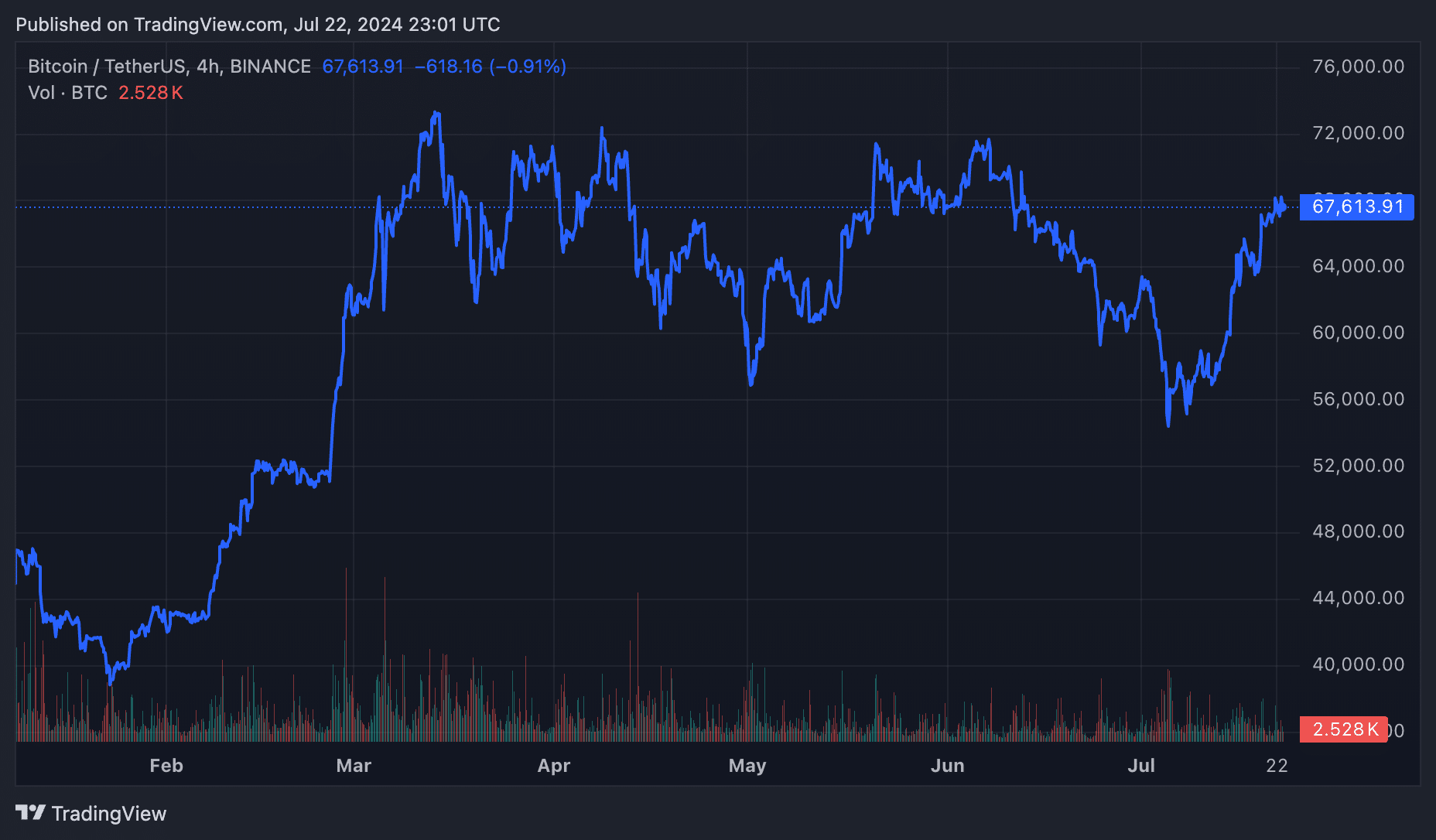

Spot BTC ETFs were approved for trading in the US in January and have sinceand, have seen record inflows. Since the launch of spot BTC ETF trading in January, the price of Bitcoin has risen by almost 50%, currently trading around $67,700.

4-hour BTC price chart, January 8 – July 22, 2024 | Source: crypto.news

4-hour BTC price chart, January 8 – July 22, 2024 | Source: crypto.news