## The Potential of Artificial Intelligence in Health Insurance## The Potential of Artificial Intelligence in Health Insurance The health insurance industry faces significant pressures, including rising medical costs and tighter Medicare Advantage reimbursements. Artificial intelligence (AI) and automation offer a potential solution for insurers to improve efficiency and profitability. Benefits of AI for Payers According to McKinsey & Co., payers could achieve substantial savings through AI: * 13-25% reduction in administrative costs * 5-11% reduction in medical costs * 3-12% increase in revenue Key Application Areas AI can be leveraged in multiple areas within the health insurance business, including: * Claims processing * Network and contracting * Utilization management * Care management * Marketing and sales Challenges and Opportunities Despite the promising outlook, the industry faces obstacles to realizing AI’s full potential: * Lagging behind in AI capabilities * Need for investments in technology and talent Roadmap for Success To overcome these obstacles, insurers must focus on: * Developing a business-driven digital roadmap * Attracting and retaining AI talent * Redesigning business models * Upgrading technology infrastructure * Improving data quality and accessibility * Implementing and scaling AI solutions Use Cases Promising use cases for AI in health insurance include: * Automated claims adjudication * Predictive modeling for utilization management * Identification of high-risk patients for early interventions * Enhanced customer service through chatbots * More accurate risk prediction for pricing and product design The Road Ahead Capturing the full benefits of AI requires not only technology investments but also organizational transformation. AI and automation could provide a competitive advantage, but the industry’s ability to adapt to this technological paradigm is crucial for its continued success.

Artificial intelligence (AI) will transform the health insurance industry, potentially lowering costs and increasing revenue for payers struggling with economic pressures. As insurers grapple with increased medical service utilization and provider costs and tighter Medicare Advantage reimbursements, AI and automation technologies offer a potential solution to improve efficiency and profitability.

According to McKinsey & Co., payers could reportedly achieve “net savings of 13 to 25 percent on administrative costs and 5 to 11 percent on medical costs” by leveraging currently available AI technologies. Furthermore, the report predicts a potential “3 to 12 percent increase in revenue” for insurers that fully embrace these innovations.

For a growing number of doctors, AI chatbots that can compose letters to insurers in seconds are reportedly speeding up the battle to approve costly claims, accomplishing in minutes what years of advocacy have failed to do. The technological shift comes as major insurance companies face class-action lawsuits for allegedly using their technology to quickly deny large volumes of claims. Experts warn it could lead to an AI-driven “arms race” in the prior authorization process, with bots fighting bots for insurance coverage.

The use of AI to deny health care claims is also under scrutiny. One class-action lawsuit alleges that health insurer Humana used an AI model called nHPredict to wrongfully deny medically necessary care to elderly and disabled patients under Medicare Advantage, a plan administered by private insurers. Another recent lawsuit alleges that United Healthcare also used nHPredict to deny claims despite knowing that about 90% of the denials were incorrect and ignored determinations of medical necessity by patients’ doctors.

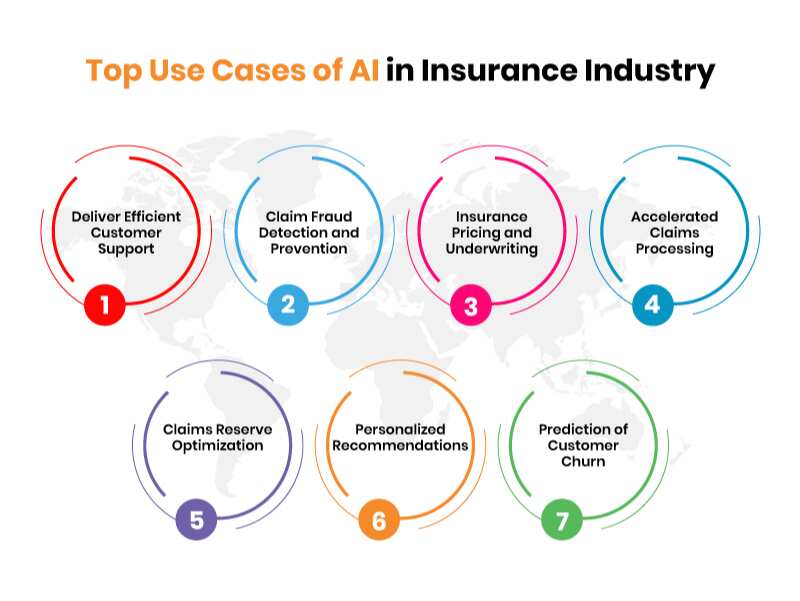

The AI Opportunity in Insurance Business

The recent McKinsey study identifies several key areas ripe for AI-driven transformation. Claims processing, network and contracting, utilization management, care management, and information technology stand out as areas where AI could have a significant impact.

Marketing and sales emerged as one of the areas with the highest potential for AI-driven improvements. The report suggested that AI could enhance targeted marketing efforts, improve customer acquisition strategies and optimize pricing models.

“To capture the full value, payers must reimagine end-to-end processes across every domain,” the report said, emphasizing that incremental changes won’t suffice. This all-encompassing approach could create significant competitive advantages for early adopters in the industry. The study noted that these estimates are based on an average-performing payer, suggesting that lower-performing companies could improve significantly by adopting AI technologies.

Despite the promising outlook, the health insurance industry faces obstacles to realizing AI’s full potential. The report noted that payers generally lag behind other industries in AI capabilities, highlighting the need for substantial investments in technology and talent.

To close this gap, insurers must focus on six critical areas identified in the report: developing a business-driven digital roadmap, attracting and retaining AI talent, redesigning business models, upgrading technology infrastructure, improving data quality and accessibility, and successfully implementing and scaling AI solutions.

The report poses challenging questions for insurance CEOs, including how they would respond to “a competitor with 20 percent lower administrative costs or one with 10 percent lower medical costs.” The report also urges executives to identify the most promising areas for AI implementation within their organizations and ensure they have access to the necessary talent and technology infrastructure.

Industry experts have identified several promising use cases for AI in health insurance. In claims processing, AI can automate adjudication, reducing processing time and errors, and identifying potential fraud. Machine learning algorithms can predict which procedures are likely to be approved or denied for utilization management, streamlining the pre-authorization process.

In healthcare management, AI can help identify high-risk patients who would benefit from early interventions, potentially reducing costly hospital readmissions. Customer service can be enhanced through chatbots and natural language processing to handle routine queries, improving response times and freeing up human agents for more complex issues. AI models can also analyze vast amounts of data to more accurately predict individual and population health risks, leading to better pricing and product design.

The road ahead

The McKinsey report suggests that capturing the full value of AI will require more than technology investments. It will require a fundamental reprogramming of paying organizations, including talent strategies, operating models and changes in organizational culture.

AI and automation could provide a critical competitive advantage as the health insurance landscape evolves. However, the industry’s ability to overcome implementation challenges and adapt to this new technological paradigm remains to be seen.

View more in: AI, artificial intelligence, automation, customer service, health diagnosis, health insurance, healthcare, insurance, insurers, marketing, news, PYMNTS News