## Impact of Assassination Attempt on Trump on Financial Markets## Impact of Assassination Attempt on Trump on Financial Markets Following the attempted assassination of Donald Trump, global financial markets exhibited signs of a strengthened “Trump trade.” This series of bets anticipates positive market outcomes should Republicans regain control of the White House, including tax cuts, higher tariffs, and reduced regulations. Positive Market Indicators * Treasury yields rose, steepening the yield curve, indicating anticipation of higher inflation. * The dollar strengthened against other currencies. * Bitcoin and S&P 500 Index futures gained value, reflecting optimism for economic growth. Increased Volatility Despite the positive market reaction, there is potential for volatility due to heightened political violence. Investors may seek safety in defensive stocks or hedge against political risk. Long-Term Outlook Analysts generally expect the assassination attempt to have a short-term impact on the market, but it could increase the likelihood of a Republican victory. This could lead to: * Continued gains for stocks in banking, healthcare, and oil industries. * Support for stocks that benefit from a steeper yield curve, particularly financial stocks. * Potential delay in Federal Reserve rate cuts due to Trump’s inflationary policies. Recollection of Past Events The market reaction mirrors that after the first presidential debate, where Biden’s poor performance boosted Trump’s election chances. Conclusion While financial markets initially reacted positively to the assassination attempt, there is potential for increased volatility. Long-term, the probability of a Republican victory remains high, leading to potential market gains in specific sectors and inflationary pressures.

By Sydney Maki and Elena Popina

As global financial markets reopened after the assassination attempt on Donald Trump, one thing seemed likely: the Trump trade would gain even more momentum.

The series of bets — based on expectations that a Republican return to the White House would lead to tax cuts, higher tariffs and looser regulations — had already gained traction since President Joe Biden’s poor performance in last month’s debate jeopardized his re-election campaign.

But the deals gained traction, with Trump mobilizing supporters and garnering sympathy by showing a relentless resilience after being shot in the ear at a rally in Pennsylvania.

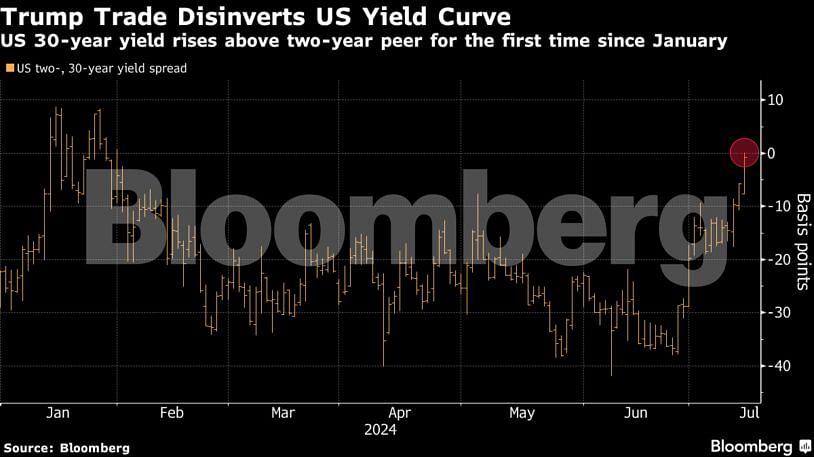

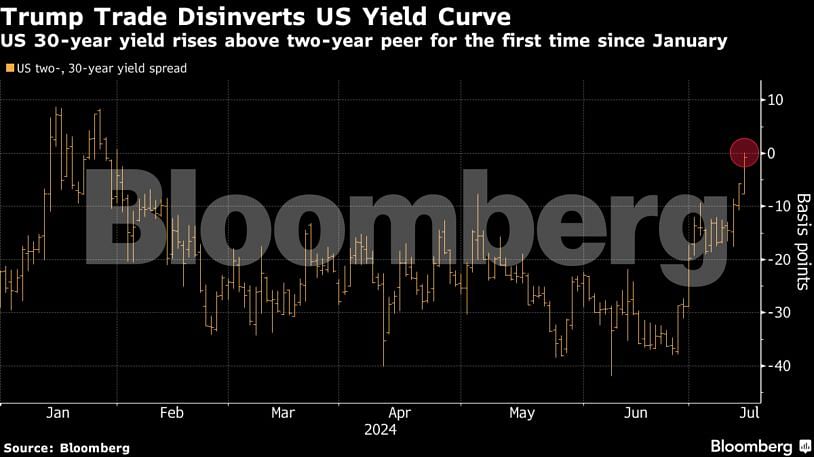

Treasuries fell as trading opened Monday, with long-dated bonds shedding losses on bets that Trump’s fiscal and trade policies will boost growth. Yields on 30-year bonds rose above two-year equivalents for the first time since January, steepening the curve.

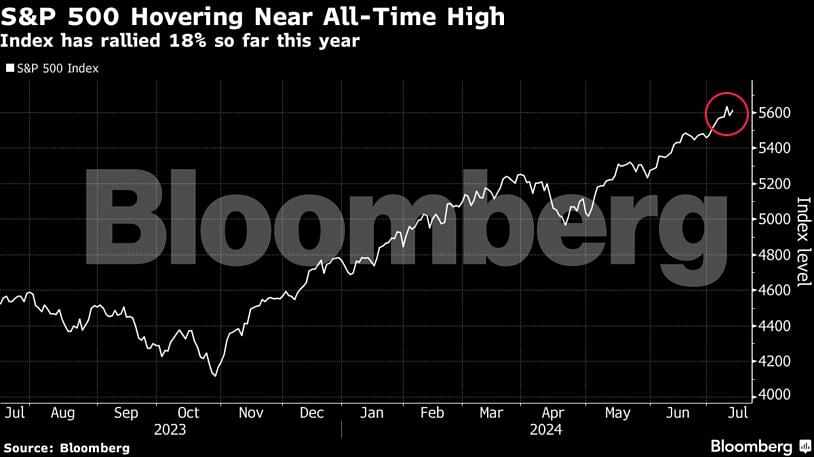

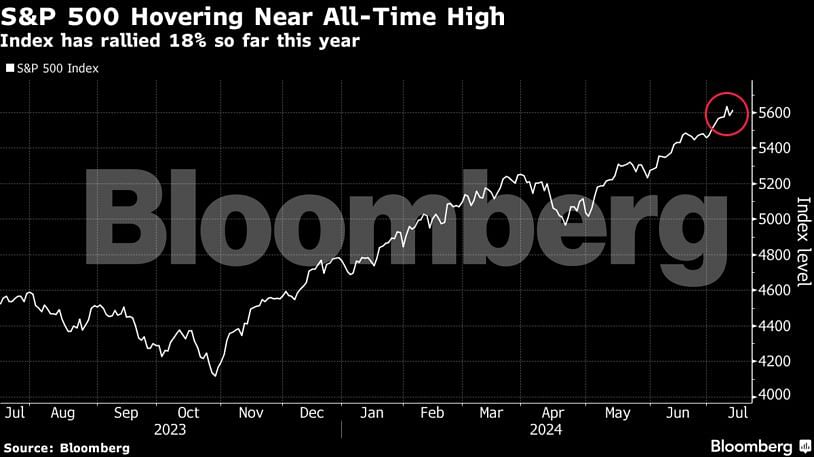

The dollar rose slightly against most other currencies, Bitcoin rose above $60,000 and S&P 500 Index futures for September rose 0.4%.

“For us, the news confirms that Trump is the frontrunner,” said Mark McCormick, global head of foreign-exchange and emerging-market strategy at Toronto Dominion Bank. “We remain bulls on the U.S. dollar in the second half and early 2025.”

Certainly, there is still plenty of room for surprises with almost four months left in the US election campaign. The rise in political violence could increase concerns about instability in the US and drive investors to safe havens, potentially overshadowing some of the market positioning that has already taken place in the run-up to the election.

Additionally, some investors may want to make a quick profit or be cautious about taking on even larger positions in an already crowded position.

“Political risk is binary and difficult to hedge, and uncertainty was high given the close nature of the race,” said Priya Misra, portfolio manager at JPMorgan Investment Management.

“This adds to the volatility. I think it further increases the likelihood of a Republican victory,” she said, adding that “the curve could come under increasing pressure.”

While traders generally do not expect Trump’s assassination attempt to derail the stock market’s trajectory in the long term, a short-term uptick in price volatility is likely. The market is already grappling with speculation that valuations have become too high, given the boom in artificial intelligence stocks and the risks associated with rising interest rates and political uncertainty.

But investors also expected stocks in the banking, health care and oil industries to benefit from a Trump victory.

“The attack will increase volatility,” said David Mazza, CEO of Roundhill Investments, who predicted that investors could temporarily seek safety in defensive stocks such as mega-cap companies. He said it “also provides support for stocks that do well in a steeper yield curve, particularly financials.”

The reaction is reminiscent of what happened after the first presidential debate in late June, when Biden’s weak performance was seen as a boost to Trump’s election chances.

While bond traders are pricing in at least two rate cuts in 2024, a significant increase in Trump’s election chances could prompt the Federal Reserve to leave rates on hold for longer, said Michael Purves, CEO and founder of Tallbacken Capital Advisors.

“Trump’s policies are — at least now — more inflationary than Biden’s,” he wrote, “and we think the Fed wants to accumulate as much dry powder as possible.”

Published July 15, 2024, 09:16 IST