The U.S. dollar index was marginally lower on Friday after data showed U.S. job growth slowed slightly in June while the unemployment rate rose, underscoring expectations that the Federal Reserve could begin cutting interest rates in September.

Nonfarm U.S. payrolls rose by 206,000 jobs last month, the Labor Department report showed. Data for May was revised sharply downward, showing 218,000 jobs added, down from the previously reported 272,000. The unemployment rate rose to 4.1%, slightly higher than the 4.0% estimate.

Investors are closely watching labor market and inflation data as they try to gauge when the Fed will cut rates from their highest level in nearly two decades.

The dollar index initially extended its declines after the data, with the dollar weakening against the yen before paring losses.

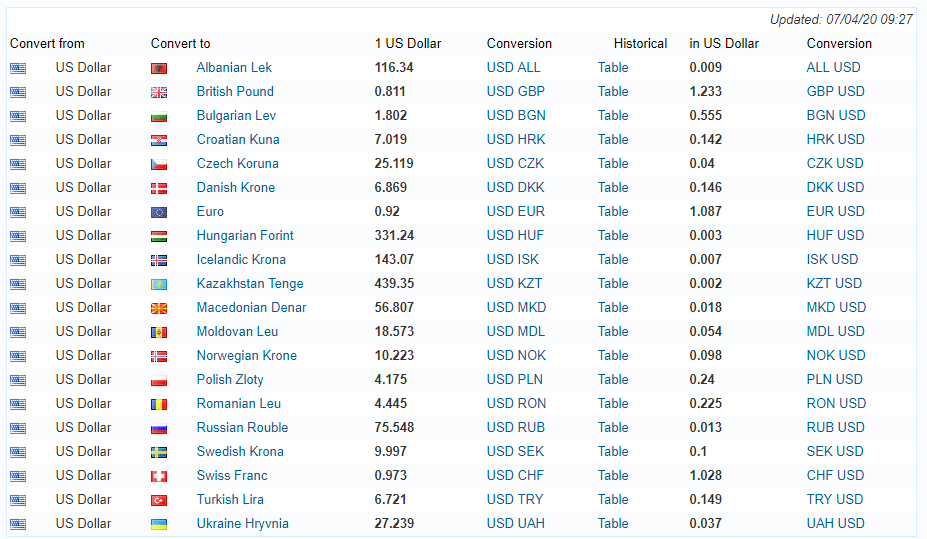

The dollar index, which compares the greenback to a basket of currencies, fell 0.28% recently to 104.87, hitting an early three-week low.

Against the Japanese yen, the dollar weakened 0.34% to 160.73. The dollar was around 160.45 shortly after the release of US payroll data.

“We see rates falling across the curve amid confirmation of moderation in the U.S. labor market. The unexpected rise in the unemployment rate, the slowdown in wage growth and revisions to prior-month earnings all point to a slowdown in labor market conditions,” said Karl Schamotta, chief market strategist at Corpay in Toronto.

“This increases the likelihood that Fed Chairman Powell will indeed put a rate cut on the table in September, either at the policy meeting in July or at the conference in Jackson Hole in August.”

According to the CME FedWatch Tool, futures markets are now pricing in about a 72% chance of a 25 basis point rate cut at the Fed’s September meeting, up from 57.9% a week ago.

The euro recently rose 0.23% to $1.0835 and is on track for its biggest weekly gain of the year against the dollar.

The euro has strengthened on signs that France is heading for a stalemate in parliament rather than a governing majority for the far-right Rassemblement National in Sunday’s elections.

Marine Le Pen’s Eurosceptic, anti-immigration Rassemblement National (RN) won the first round of parliamentary elections with a third of the vote, raising the prospect of the far right gaining an advantage.

For the first time since World War II, there is a French government again.

The pound rose as the Labour Party secured a landslide victory in the UK general election.

The pound rose 0.46% to $1.2814.

Bitcoin was poised for its biggest weekly drop in nearly a year as traders worried about the likely dumping of tokens from defunct Japanese exchange Mt. Gox and further selling by leveraged players following the cryptocurrency’s strong run.

The price of the world’s largest cryptocurrency fell as much as 8% on the day to $53,523, its lowest level since late February. It was on track for its biggest weekly drop since August 2023.

Bitcoin was last down 3.08% to $56,530.00. Ethereum was down 4.81% to $2991.8.