Johnson & Johnson (JNJ): Positives and Negatives in a Changing LandscapeJohnson & Johnson (JNJ): Positives and Negatives in a Changing Landscape Underperformance and Declining Estimates Johnson & Johnson (JNJ) shares have underperformed the industry and the S&P 500 over the past year. The consensus earnings estimates have also fallen recently, raising concerns among analysts. Legal and Other Problems JNJ faces significant legal challenges, including lawsuits alleging injuries from its talc and opioid products. The company also faces the expiration of a patent on its blockbuster drug Stelara in 2025, which could impact its revenue and profits. Positives: Diversification and Innovation Despite these challenges, JNJ remains a highly diversified business with over 275 subsidiaries. It has a strong R&D budget and has achieved consistent growth in its Innovative Medicines unit. MedTech Segment Recovery JNJ’s MedTech segment has shown improvement in sales since 2022, benefiting from the recovery in surgical procedures and new product launches. Attractive Valuation JNJ shares appear undervalued compared to the industry and are trading below their average price-to-earnings ratio. Conclusion JNJ’s segments are currently growing, and the company has significant resources to pursue acquisitions. However, the ongoing legal battle remains a concern, and investors should proceed with caution. While long-term investors may consider buying JNJ at its current price, new investors are advised to wait until the legal uncertainty is resolved. Those looking for a large pharmaceutical investment may consider New Nordisk (NVO) instead, which has a Zacks Rank #2 (Buy).

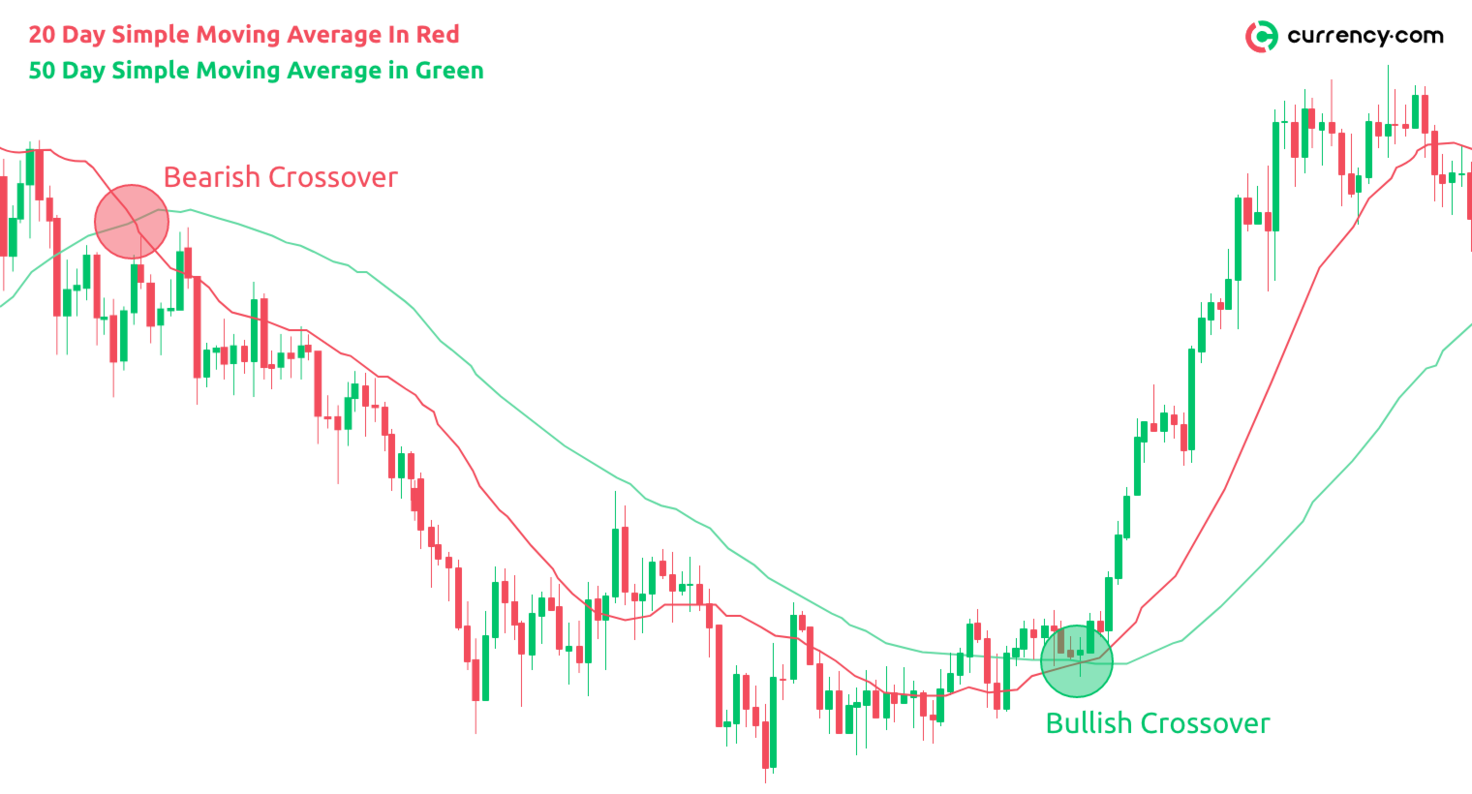

Johnson & Johnson‘S (JNJ Quick quoteJNJ – Free Report) shares have been trading below their 200-day and 50-day moving averages since late June. On July 3, the stock’s closing price of $145.69 was below its 50-day moving average of $147.61 and its 200-day moving average of 151.95.

Over the past year, J&J’s stock has fallen 9.9% while the industry has risen 28.9%. The stock has also underperformed the industry and the S&P 500.

JNJ stock underperforms industry, sector and S&P 500

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Declining estimates

The Zacks Consensus Estimate for earnings has declined over the past 60 days from $10.65 to $10.62 per share for 2024 and from $10.93 to $10.92 per share for 2025.

JNJ Estimate Movement

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

J&J’s legal and other problems

J&J, a health care powerhouse, is facing a wave of lawsuits alleging that patients have suffered personal injuries from using its medicines, primarily its talc and opioid products. J&J is facing more than 60,000 lawsuits over its talc products. The lawsuits allege that its talc products contain asbestos, which has caused many women to develop ovarian cancer.

J&J’s subsidiary, LTL Management, which was created to manage claims in the cosmetic talc lawsuit, filed for voluntary bankruptcy twice to equitably resolve all current and future talc-related claims. However, both bankruptcy petitions were dismissed by the courts, stating that J&J was not in sufficient financial distress to qualify for bankruptcy. In May, LTL Management proposed a new plan to resolve all current and future pending talc ovarian cancer lawsuits.

J&J also faces the expiration of its patent on its blockbuster drug Stelara in 2025. Stelara generated $10.9 billion in sales in 2023. The launch of generics could significantly erode the drug’s sales and harm J&J’s revenue and profits.

But not everything is going wrong for J&J. Let’s discuss the positives.

The most diversified drug manufacturer

J&J’s greatest strength is its diversified business model. In August 2023, J&J completely spun off its Consumer Health business into a new publicly traded company called Kenvue (KVUE Quick quoteKVUE – Free Report), which now operates as a separate and fully independent company. With the complete separation of the Consumer Health segment, J&J has now become a dual-sector company focused on the pharmaceutical and medtech fields.

It has over 275 subsidiaries, which clearly means that the company is extremely well diversified. The diversification helps it to weather economic cycles more effectively. J&J has 26 platforms with over $1 billion in annual sales. It also has one of the largest R&D budgets among pharmaceutical companies.

Innovative Medicines Unit Shows Consistent Strength

J&J’s Innovative Medicine (formerly Pharmaceuticals) unit is performing above market levels. Growth is being driven by existing products such as Darzalex, Stelara, Tremfya, Uptravi and Erleada, as well as the continued absorption of new launches including Spravato, Carvykti and Tecvayli. J&J aims to grow the Innovative Medicines unit to a $60 billion segment ($57 billion on a constant currency basis) by 2025. Revenue for the segment grew 13.6% in 2021, 6.8% in 2022 and 5.9% in 2023 on an organic basis. J&J expects the Innovative Medicine business to grow 5% to 7% from 2025 to 2030.

MedTech segment trends improve

While J&J’s MedTech segment was hit by a decline in elective surgeries during the pandemic years, sales have improved since 2022 due to the recovery in surgical procedures and the segment’s improved competitiveness through new product launches. The company has also strengthened its medical device portfolio through acquisitions. In 2022, J&J acquired Abiomed, boosting MedTech’s presence in higher-growth segments. In May 2024, J&J acquired Shockwave Medical, which is expected to strengthen its position in the fastest-growing, innovation-driven cardiovascular interventional segments.

Attractive valuation

From a valuation standpoint, J&J appears attractive relative to the industry and is trading below average. Looking at the price-to-earnings ratio, the company’s shares are currently trading at 13.53 forward earnings, below the industry’s 20.02 and the stock’s average of 16.07. The stock is also trading near its 52-week low.

JNJ Stock Valuation

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion

J&J’s segments are on a growth trend and will likely continue to do so in the coming years. The company has ample resources to pursue bolt-on acquisitions and deals to bolster its portfolio. J&J spent $17 billion on M&A deals in 2022 and $3 billion in 2023. The company also returns value to shareholders through share buybacks and dividend payments. It has increased its dividends for 62 consecutive years. The current dividend yield of around 3.4% is attractive. However, the company will likely continue to incur billions of dollars in legal fees in future quarters due to its ongoing litigation.

The recent drop in the stock price has investors wondering if this is a buying opportunity. We would advise a new investor not to buy J&J stock at this time due to the uncertainty surrounding the legal battle. An investor interested in buying a large pharmaceutical company may consider investing in New Nordisk (NVO Quick quoteNVO – Free Report) instead, which carries a Zacks Rank #2 (Buy).

However, those who already own J&J stock can continue to invest, as the company is generating decent revenue and profit growth. If J&J is able to fully resolve its talc lawsuits, it will eliminate a significant overhang on the stock and make it an attractive investment. Long-term investors may want to consider buying J&J stock given the recent price decline.

J&J currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.