AIA, a major insurance provider, has released data on the claims it processed in 2023. According to the report, AIA accepted 92% of claims last year, a 1% decrease from 2022 when it accepted 93% of claims. In 2021, AIA paid out 94% of claims.AIA, a major insurance provider, has released data on the claims it processed in 2023. According to the report, AIA accepted 92% of claims last year, a 1% decrease from 2022 when it accepted 93% of claims. In 2021, AIA paid out 94% of claims. Despite a slight decline in the claims acceptance rate, AIA paid $734 million to customers in 2023, an increase of $88 million from 2022 ($646 million). Life claims accounted for the largest share of payouts, totaling $263 million ($233 million in 2022), followed by health claims at $143 million ($121 million in 2022), and trauma claims at $117 million ($111 million in 2022). The report also reveals an increase in cancer-related claims, which made up 60% of life claims paid in 2023, up from 47% in 2022. The majority of life insurance claims were for individuals aged 50 to 59. Health claims saw a 6% increase last year, with the musculoskeletal system accounting for a quarter of all such claims. Cancer treatments and digestive problems also contributed significantly to health insurance claims. In terms of trauma claims, breast cancer was the most common reason for claims (61%), consistent with the rise in cancer-related life insurance claims. AIA paid out over $16 million in claims for individuals aged 20 to 29, including $2.6 million for life insurance. Claims for 30 to 39-year-olds totaled over $58 million, with $4.7 million related to cancer. The 50 to 59 age group had the highest claims amount, costing AIA $197 million. This included $87 million for life claims, $34 million for healthcare, $39 million for trauma, and $8 million for TPD. A notable finding from the report is that mental health was a significant factor in TPD claims, with $2.4 million paid out in 2023. Despite the increase in claims amounts, AIA’s customer base saw a slight decrease from 815,000 in 2022 to 800,000 in 2023.

According to just-released data, AIA accepted fewer claims last year. In 2023 it accepted 92% of all claims, one percentage point lower than in 2022 (93%). In 2021, it paid 94% of claims. However, last year it paid $734 million to customers, an increase of $88 million from 2022 ($646 million).

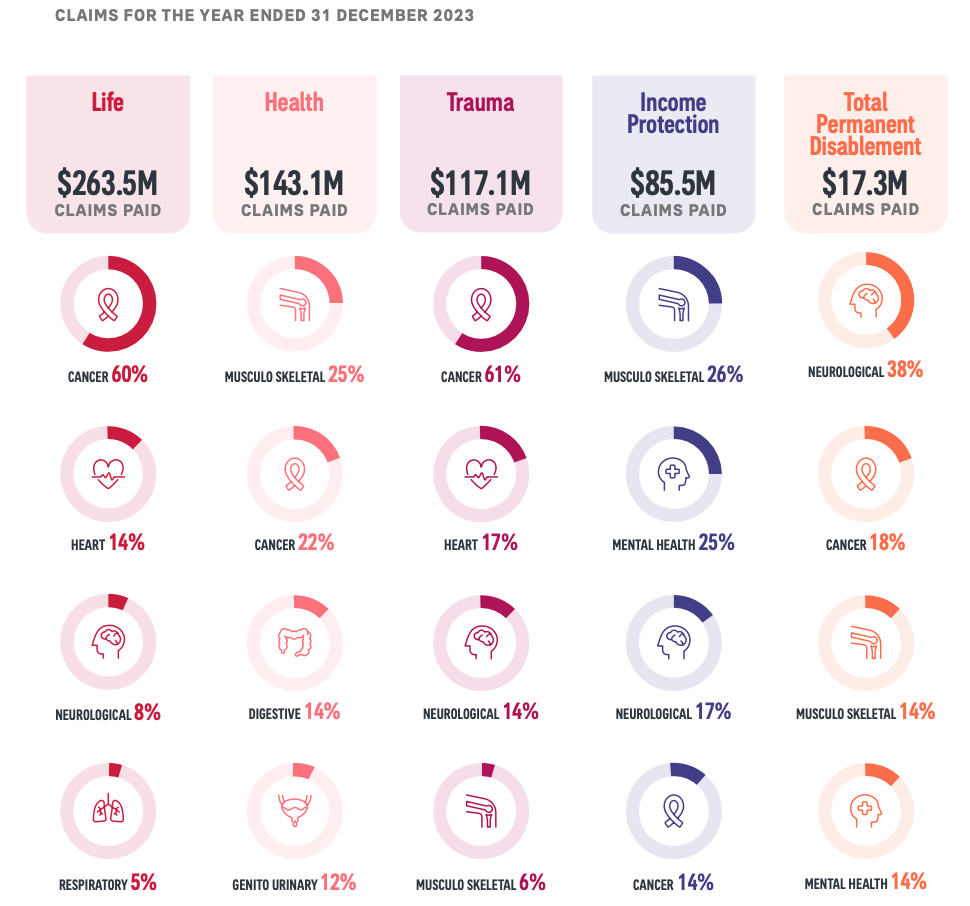

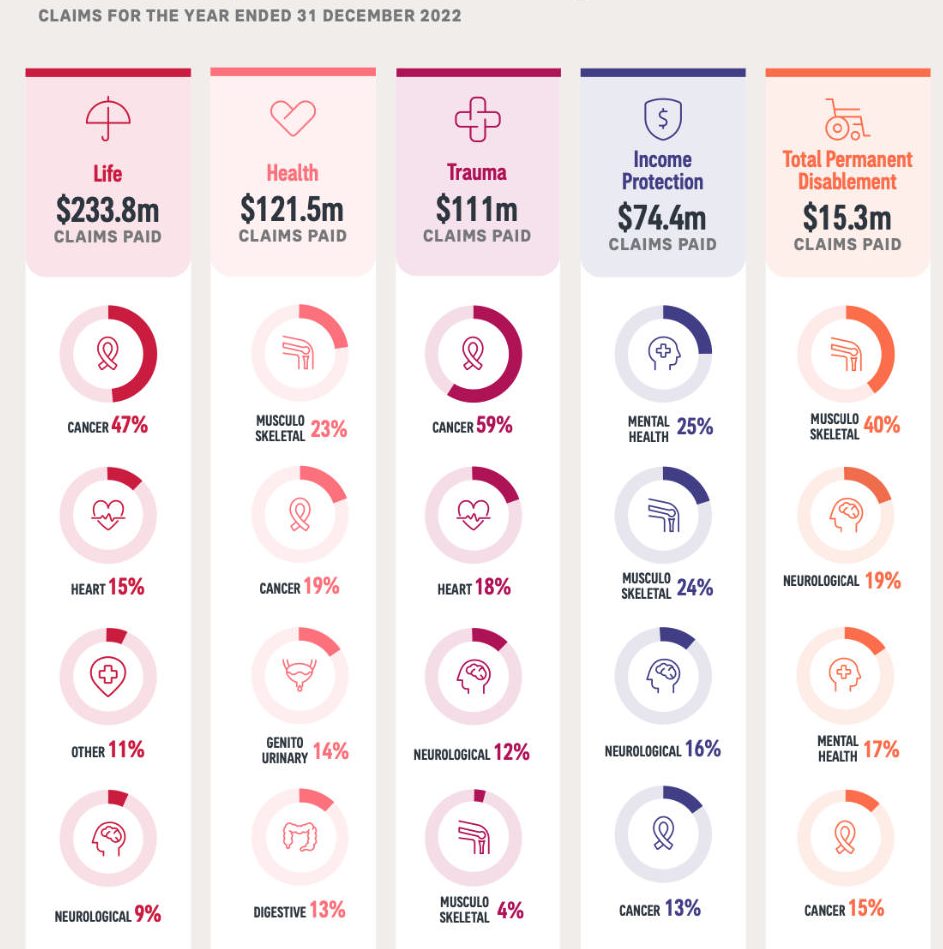

Life claims payments made up the largest amount at $263 million ($233 million in 2022), health follows at $143 million ($121 million in 2022), and trauma claims for the year totaled $117 million ($111 million in 2022).

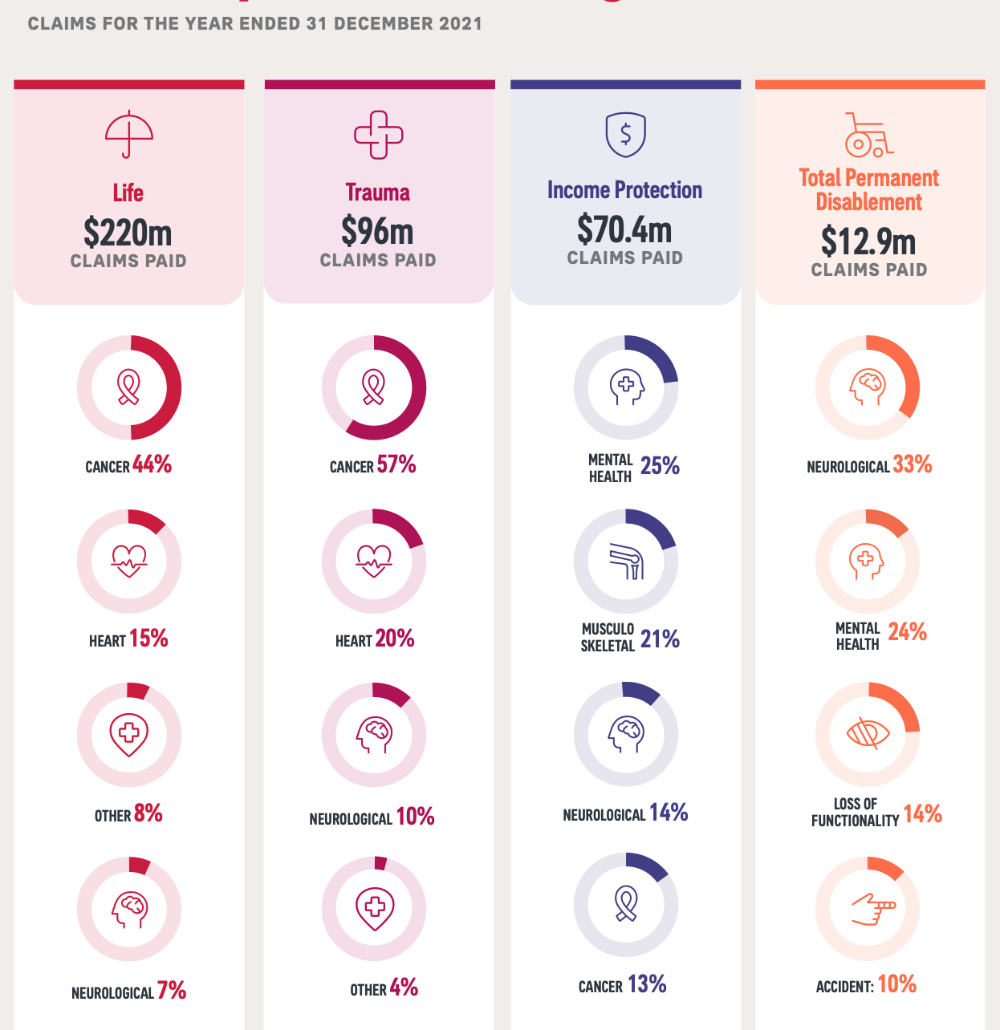

Of life claims paid in the calendar year 2023, cancer topped the list of causes at 60%, indicating an increase in such claims; these were 44% in 2021 and 47% in 2022. Most life insurance claims were for those aged 50 to 59.

AIA claims paid for 2023.

AIA claims paid for 2023.

The AIA data also shows that health claims increased by 6% last year, with the musculoskeletal system making up a quarter of all health claims. Cancer treatments accounted for 22% of health insurance claims, while digestive problems accounted for 14%.

In terms of trauma claims, breast cancer was the most common claim at 61% (59% in 2022), which is in line with the increase in cancer-related life insurance claims.

More than $16 million was paid for 20 to 29-year-olds, including $2.6 million for life insurance.

All claims for 30 to 39 year olds amounted to more than $58 million, including $4.7 million for life claims related to cancer. The total value of life claims for this age group was $15.7 million for the year, health care $12.2 million, trauma $15 million and income protection $14.7 million.

Claims for people aged 40 to 49 were over $127 million, but by far the largest amount paid by AIA in 2023 was for the 50 to 59 group, costing the company $197 million. This included $87 million for life claims, $34 million for healthcare, trauma, $39 million and $8 million TPD.

More than $139 million was paid for people aged 60 to 69, and $71 million for people aged 70 and over.

The company says mental health was one of the top reasons why Kiwis were not working in 2023, with almost $2.4 million paid in related claims under TPD policies.

AIA has more than 800,000 customers, 15,000 fewer than in 2022 (800,000 in 2021).

Download AIA claims paid data for 2023, 2022 and 2021.

Bottom: Three years of claims data from AIA NZ.

AIA claims paid in 2023. Data and graphics AIA NZ.

AIA claims paid in 2023. Data and graphics AIA NZ.  AIA claims paid in 2022. AIA NZ data and graph.

AIA claims paid in 2022. AIA NZ data and graph.  AIA claims paid in 2021. Data and graphics AIA NZ.

AIA claims paid in 2021. Data and graphics AIA NZ.