Parents in the creative and marketing industries feel pressure to prioritize their work

More than four in five (83%) working parents in the creative, marketing and related sectors feel pressure to prioritize work over parenting duties, according to research conducted by Ketchum on behalf of Philips.

While more than three-quarters (78%) of working parents believe their employers provide sufficient support; an even greater share (81%) believe they have to sacrifice their family life to achieve their career goals.

The vast majority of working parents indicate that they have little time for themselves; 78% indicate that they have less than an hour a day for themselves. However, there is a gap between working mothers and fathers, with 86% of women reporting taking care of themselves for less than an hour a day, compared to 52% of men surveyed.

Nearly half (44%) of working parents say they face difficulty attending work events such as Cannes because they don’t want or can’t leave their children behind. Nearly half of women (46%) have to be selective when attending work events, compared to 39% of men.

Despite this, less than one in five (19%) of non-parents recognize the difficulties working parents face when attending work events.

Source: Philips and Ketchum

Most marketers fear burnout in their current role

According to research from the Chartered Institute of Marketing (CIM), more than half (56%) of marketers are concerned about burnout in their current role.

According to research from the Chartered Institute of Marketing (CIM), more than half (56%) of marketers are concerned about burnout in their current role.

Younger marketers are more likely to fear burnout than older people in the industry. Just under three-fifths (59%) of 25-to-34-year-olds say they worry about burnout, compared to just 38% of 45-to-54-year-olds.

Despite the prevailing fear of burnout among marketers, the research suggests employers are thinking more carefully about mental health. About three-quarters (74%) of marketers surveyed say their employers are taking their employees’ mental health more seriously than before the pandemic.

The research also suggests that marketers have not seen significant salary increases in recent times. About a fifth (18%) say their salaries have remained the same over the past twelve months, with just over a third (36%) reporting modest increases of between 1% and 5%.

One factor putting pressure on marketers is concern about their organization’s investments in marketing. Nearly three in five (59%) say they are concerned that brands are spending less due to external financial pressures. Just under half (49%) say they are concerned that the growth of Britain’s marketing industry will be outpaced by its international competitors.

Source: Chartered Institute of Marketing

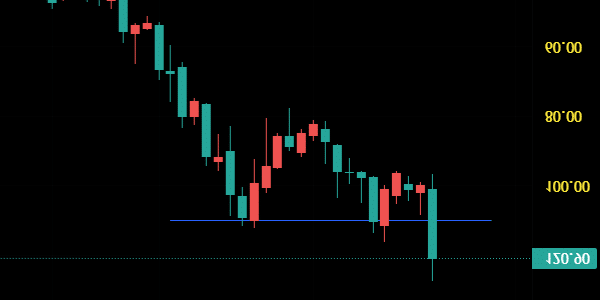

Grocery sales are showing slow growth despite normalizing inflation

Grocery sales grew last month at the weakest level since June 2022, despite price inflation falling for the sixteenth month in a row.

The 1% increase in sales of take-home groceries in the four weeks to June 9 was the slowest growth since June 2022, with rain hampering sales as the average shopper visited supermarkets 16.3 times in the rainy month, compared to 16.4 times in the rainy month. June last year, according to figures from Kantar.

While grab-and-go sales growth was slow, more premium retailers performed well this month.

Online retailer Ocado saw sales increase by 10.7% in twelve weeks, meaning it was the fastest growing supermarket in Britain for the fourth month in a row. It now accounts for 1.8% of the total supermarket market.

Waitrose has also experienced strong growth in recent times. The supermarket attracted 188,000 new customers in the 12 weeks to May 9, a bigger increase than any of its rivals. Sales also grew by 3.5% compared to the same period in 2023.

Food price inflation now stands at 2.1%, Kantar reports, something that has contributed to a rise in consumer confidence, with 36% of households now describing their financial position as ‘comfortable’, the highest percentage since November 2021. The jump in ‘comfortable’ ‘Households were the largest since early 2023.

Source: Kantar

UK advertising industry exports hit £18bn by 2023, ahead of telecommunications and legal sectors

Britain’s reputation as a global advertising giant has been boosted by new figures showing a substantial increase in the country’s advertising exports.

Britain’s reputation as a global advertising giant has been boosted by new figures showing a substantial increase in the country’s advertising exports.

The value of UK advertising exports grew by 15% to £18 billion by 2023, a figure four times higher than a decade ago. Britain is the second largest advertising exporter in the world, behind only the US.

Based on the figures, British advertising exports are worth more than exports in the engineering, telecommunications, legal, accounting, audiovisual or architectural sectors.

In terms of who buys UK advertising services, the US is the biggest importer, with £3.4 billion worth of UK advertising. Germany and France import £1.2 billion and £1 billion respectively.

Exports to Europe, including both EU and non-EU countries, account for 63% (£11.4bn) of UK advertising exports.

The gap between British and US exports has now narrowed from US$4.7 billion (US$3.7 billion) to US$3 billion (US$2.4 billion), according to advertising think tank Credos’ analysis of data from the Office for National Statistics, on behalf of the United Kingdom. Export Group (UKAEG).

Source: Credos and the UK Advertising Export Group

Corporate reputation is seen as the cornerstone of brand differentiation

Senior business leaders view corporate reputation as a “cornerstone” of brand differentiation, according to research from Bloomberg Media Group.

Senior business leaders view corporate reputation as a “cornerstone” of brand differentiation, according to research from Bloomberg Media Group.

When it comes to what influences corporate reputation, trust is considered most important, with over a quarter (26%) of respondents associating corporate reputation with trust and ethical practices.

Marketers are considered one of the positions most responsible for building corporate reputation, with half of senior business leaders considering this position to be responsible. However, the research also shows that marketers are typically the most skeptical about the benefits of corporate reputation, with one in two marketers admitting to spending 10% or less of their budget on corporate reputation.

In terms of channels for building corporate reputation, digital media is the most popular among senior business leaders. However, 61% believe that the negative impact of advanced technology such as generative AI on business reputation will outweigh the benefits.

Source: Bloomberg Media Group