Prosus NV (Prosus) (AEX and JSE: PRX): It was an excellent year for the Group. Prosus simplified the group structure, delivered improvements on all key performance measures and achieved e-commerce profitability six months ahead of target. Operations have performed well, accelerating profitable growth, while the open-ended buyback program continues to deliver value to our shareholders every day. The rapid deployment of AI-driven technologies across the Prosus ecosystem is delivering real results and will define the next frontier of value creation for the Group. Prosus has a strong balance sheet and is well positioned to generate better returns through smart and disciplined capital allocation, driving value for all stakeholders.

On May 17, 2024, the Board of Directors announced the appointment of Fabricio Bloisi, former CEO of iFood, as CEO of Prosus and Naspers Group, with effect from July 1, 2024. Ervin Tu, Interim Group CEO, will become Group President and Chief Investment Officer (CIO).

-

Accelerated industry-leading revenue growth of 19%, with consolidated e-commerce revenue of $5.5 billion.

-

Consolidated e-commerce profitability exceeds target at US$451 million1 improving trading profits to $38 million.

-

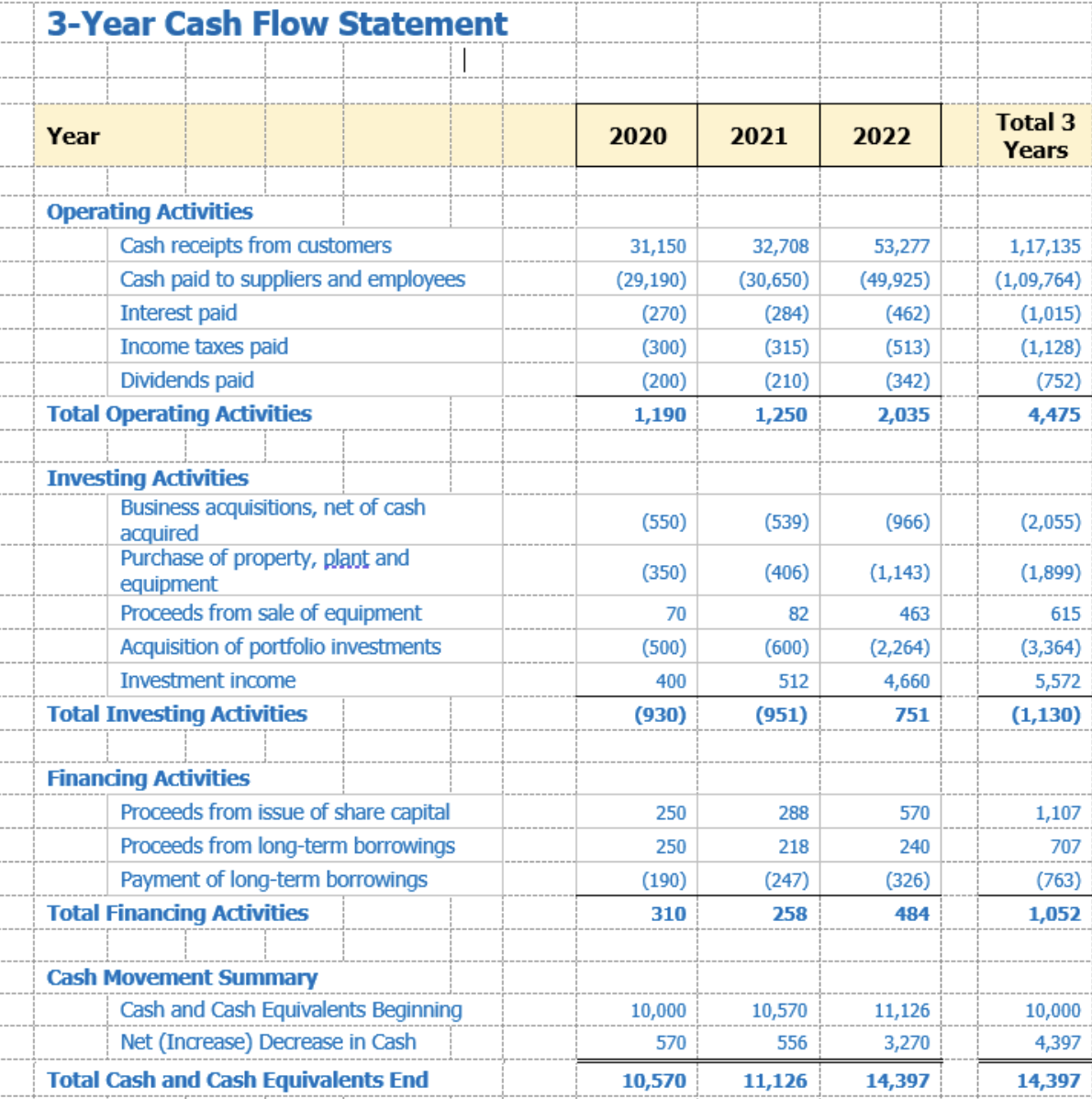

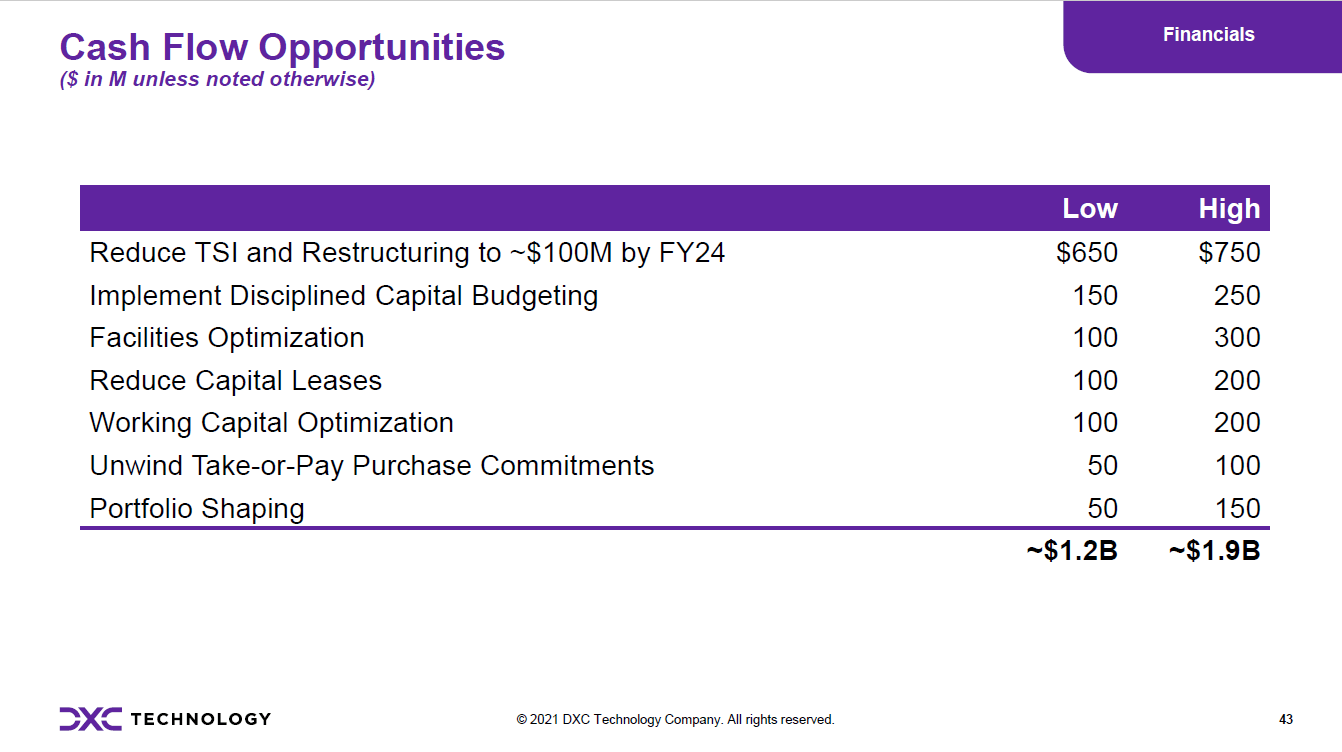

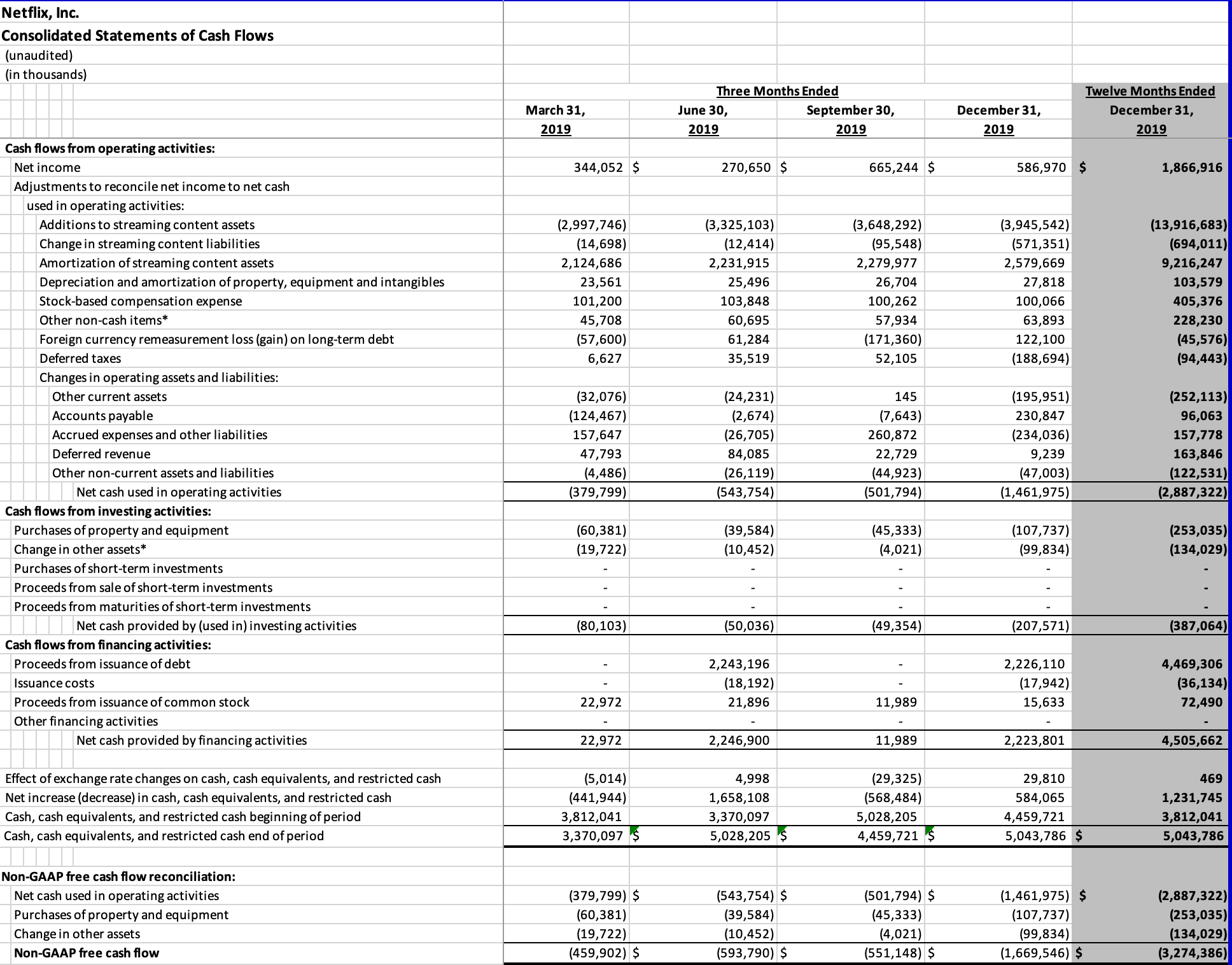

Free cash flow increased by US$773 million to US$524 million, a threefold improvement year-on-year.

-

US$35 billion in value created by the ongoing buyback program since launch, adding 8% to net asset value per share.

-

The group structure has been simplified by removing the mutual holding agreement between Prosus and Naspers.

Ervin Tu, CEO of the Interim Group, Prosus and Naspers, commented: “We have made significant progress this year in delivering on our strategy. Our e-commerce portfolio is profitable for the first time ever and our continued buybacks have created significant shareholder value. We have also reorganized the Group, bringing us closer to our businesses so we can further improve their performance. AI remains the top priority, and our in-house AI expertise, combined with our real-world implementation of AI across our portfolio, are clear competitive advantages. AI plays an important role in our efforts to build and invest in the next wave of technology leaders.”

Fabricio Bloisi, the new CEO of the Group, said: “These results illustrate the amazing progress we have made, as well as our future potential. Prosus operates in some of the most dynamic markets in the world and through our technology ecosystem we can make a real difference in the lives of our more than two billion customers. In June, I learned more about our company and am even more excited about the potential to further leverage our ecosystem and continue to improve our results. I am confident in our ability to innovate, collaborate and lead within existing and new industries, and to grow the profitability of our businesses. I will start on July 1, 2024 and am excited about the enormous potential I see to generate long-term value for all our stakeholders.”

Group performance

|

Consolidated results for continuing operations |

|||

|

Group |

Financial year 2024 |

Financial year 2023 |

YoY change |

|

Income |

$5.5 billion |

$4.9 billion |

19% |

|

Adjusted EBITDA |

(US$13 million) |

(US$480 million) |

n/a |

|

Trading profit / (loss) |

(US$118 million) |

(US$586 million) |

79% |

|

Core revenues |

$5.0 billion |

$2.7 billion |

84%1 |

|

E-commerce portfolio |

|||

|

Income |

$5.5 billion |

$4.9 billion |

19% |

|

Adjusted EBITDA |

$136 million |

(US$314 million) |

n/a |

|

Trading profit / (loss) |

$38 million |

(US$413 million) |

109% |

|

Food delivery |

|||

|

Income |

$1.2 billion |

$1.4 billion |

22% |

|

Adjusted EBITDA |

$77 million |

(US$94 million) |

n/a |

|

Trading profit / (loss) |

$67 million |

(US$106 million) |

161% |

|

Ads |

|||

|

Income |

$707 million |

$519 million |

27% |

|

Adjusted EBITDA |

$187 million |

$73 million |

n/a |

|

Trading profit / (loss) |

$172 million |

$56 million |

182% |

|

Payments Fintech |

|||

|

Income |

$1.1 billion |

$903 million |

38% |

|

Adjusted EBITDA |

(US$23 million) |

(US$77 million) |

n/a |

|

Trading profit / (loss) |

(US$31 million) |

(US$83 million) |

81% |

|

Edtech |

|||

|

Income |

$148 million |

$134 million |

9% |

|

Adjusted EBITDA |

(US$91 million) |

(US$122 million) |

n/a |

|

Trading profit / (loss) |

(US$98 million) |

(US$131 million) |

25% |

|

Etail |

|||

|

Income |

$2.2 billion |

$1.9 billion |

8% |

|

Adjusted EBITDA |

$21 million |

(US$9 million) |

n/a |

|

Trading profit / (loss) |

(US$35 million) |

(US$61 million) |

44% |

|

Economic importance results from continued activities |

|||

|

Group |

|||

|

Income |

$31.7 billion |

$31.4 billion |

12% |

|

Adjusted EBITDA |

$7.0 billion |

$5.0 billion |

n/a |

|

Trading profit / (loss) |

$5.8 billion |

$3.6 billion |

82% |

Basil Sgourdos, Group CFO, Prosus and Naspers, commented: “After a year of strong execution, our e-commerce portfolio is profitable for the first time, well above target. In addition, our industry-leading growth has accelerated and profitable growth is expected to continue. Core revenues nearly doubled, and our strong e-commerce results and performance at Tencent led to a tripling of free cash flow. Our strong and flexible balance sheet, active portfolio management and disciplined capital allocation place us in a strong position to deliver on our long-term strategy.”

Industry-leading growth and increasing profitability across the entire e-commerce portfolio

Food Delivery: iFood grew well and improved profitability significantly

-

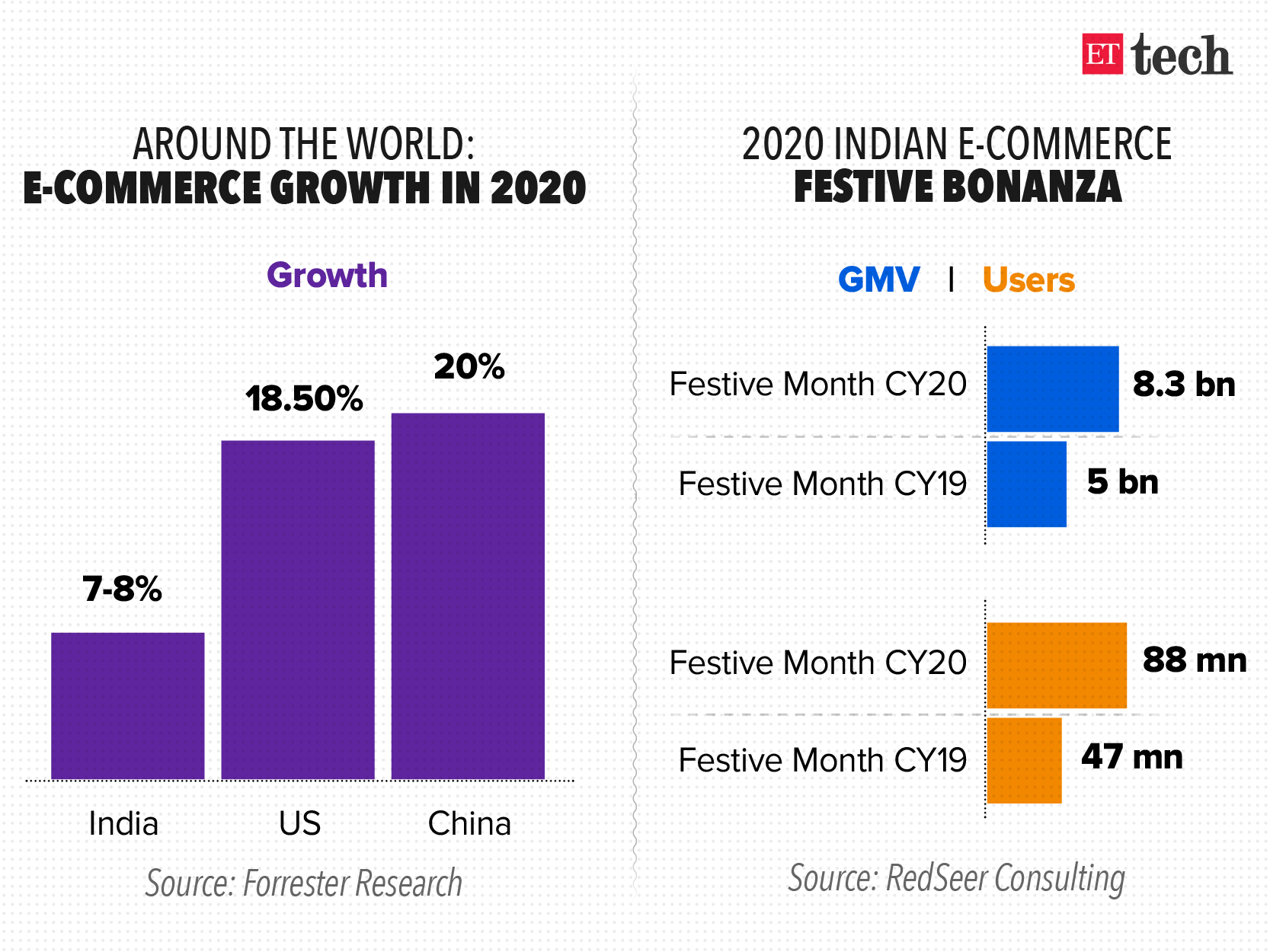

iFood delivered industry-leading sales growth, with gross merchandise value (GMV) increasing 20%, orders increasing 18% and revenue increasing 22%.

-

iFood’s core restaurant business nearly tripled to $260 million, with a 24% trading margin.

-

Overall, iFood’s trading profit rose significantly to $96 million, an increase of 249%, supported by optimized marketing spend and increased cost control.

-

Delivery Hero grew the group’s GMV by 6% for the year ended December 31, 2023, with revenue up 16%, boosting profitability to adjusted EBITDA of €254 million.

-

Swiggy increased gross order value (GOV) by 26% as operating metrics improved and adjusted EBITDA improved to a loss of $261 million.

Advertising – OLX Group: Strong performance, with accelerated growth and expanding margins

-

Classifieds’ consolidated revenue grew 27% thanks to strong performance at OLX Europe, particularly in the automotive category, and a recovery at OLX Ukraine.

-

Trading profit more than tripled to $172 million, with the trading profit margin increasing by 13 percentage points to 24%.

-

Performance driven by streamlining operations, more effective marketing spend and strategic optimization of technology hubs.

-

Exited OLX Autos business (excluding US).

Payments Fintech – PayU: Strong growth within core Payments Service Provider (PSP) activities and improved overall profitability

-

Consolidated revenue grew 38% to $1.1 billion, driven by growth in PSP’s core businesses in India and at GPO.

-

Core PSP grew revenue by 41%, total payment volume (TPV) increased by 25% and delivered trading profit of $19 million.

-

Standout performance at Iyzico, PayU’s Turkish PSP business, with revenue up 119% in nominal terms and trading profit of US$17 million.

-

Overall, consolidated trading loss improved by 81% to US$31 million, with a 6 percentage point improvement in trading profit margin.

-

We have received in-principle approval from the Reserve Bank of India to act as a payment aggregator, allowing PayU India to once again onboard new merchants.

-

Sale of GPO activities to Rapyd (excluding PayU Turkey and Red Dot Payment), with expected closure in calendar 2024.

-

Strong performance at Remitly for the year ending December 31, 2023, with revenue up 44% and EBITDA margin up to 5%.

Edtech: Strategic focus on AI investments as trading losses decline

-

Consolidated sales grew 9% to $148 million, while trading losses fell 25% to $98 million.

-

Stack Overflow’s turnaround is underway, with second-half losses cut by 70% from $44 million to $13 million.

-

Stack Overflow introduced OverflowAPI, allowing AI and LLM providers to leverage Stack’s public dataset within their own AI capabilities. API partnerships recently signed with Google and OpenAI.

-

Stack Overflow recently launched the OverflowAI product for general availability.

-

GoodHabitz grew sales by 20%, while trading losses halved to $8 million.

|

Please note that the group results are presented on a consolidated basis from continuing operations, which reflect all majority owned and operated companies. All business units of OLX Autos are classified as discontinued operations, in line with the disclosures under IFRS. All growth rates shown here are expressed in local currency, excluding the impact of acquisitions and divestitures (M), unless otherwise stated. The growth rates shown here for all non-financial key performance indicators compare FY24 to FY23. |

1On a nominal basis.

For full details of the Group’s results, please visit www.prosus.com.

About Prosus:

Prosus is a global consumer internet group and one of the largest technology investors in the world. Operating globally, Prosus invests in markets with long-term growth potential and builds leading consumer internet companies that empower people and enrich communities.

The Group focuses on building meaningful businesses in the online advertising, food delivery, payment fintech and education technology sectors. Through the Prosus Ventures team, the Group invests in new technology growth opportunities in logistics, fintech, healthcare, blockchain, social and e-commerce platforms, agriculture and more.

The Group actively supports exceptional entrepreneurs who use technology to improve people’s daily lives. Every month, more than two billion customers around the world use the products and services of companies in which Prosus has invested, acquired or built up.

Prosus has a primary listing on Euronext Amsterdam (AEX:PRX) and secondary listings on the Johannesburg Stock Exchange (XJSE:PRX) and a2X Markets (PRX.AJ). Prosus is largely owned by Naspers.

For more information, please visit www.prosus.com.

View the source version on businesswire.com: https://www.businesswire.com/news/home/20240623072242/en/