Don’t Buy Comerica Incorporated (NYSE:CMA) for its Next Dividend Without Doing These Checks

1. Evaluate CMA’s financial health:

* Check its balance sheet for assets, liabilities, and equity. * Review its income statement for revenue, expenses, and profits. * Assess its cash flow statement for operating, investing, and financing activities.

2. Determine dividend history and sustainability:

* Confirm the company has a history of paying dividends. * Calculate the dividend payout ratio (dividends paid / net income) to ensure it is sustainable. * Consider the company’s earnings outlook and projected growth to gauge future dividend potential.

3. Check earnings and cash flow stability:

* Analyze the company’s earnings per share (EPS) over time to assess its earnings power. * Evaluate its operating cash flow to ensure it can cover dividend payments. * Consider the impact of economic conditions and industry trends on its financial performance.

4. Assess debt and leverage:

* Review the company’s debt-to-equity ratio to determine its leverage level. * Consider the impact of additional debt on its financial stability and dividend capacity. * Examine its credit ratings to gauge its financial strength.

5. Consider the company’s outlook and growth prospects:

* Evaluate the company’s strategic plan and growth initiatives. * Assess the industry outlook and competitive landscape to determine its future potential. * Consider the impact of technology and regulation on its business operations.

6. Compare CMA to peers:

* Benchmark CMA’s financial metrics and dividend yield against similar companies in the industry. * Identify any outliers or areas where CMA stands out to assess its relative performance.

7. Seek professional advice if necessary:

* If you are unsure about CMA’s financial health or dividend prospects, consider consulting with a financial advisor for professional guidance. Remember, investing in dividends involves understanding the company’s financial condition and long-term prospects. By conducting these checks, investors can mitigate risks and make informed decisions about whether to invest in Comerica Incorporated (CMA) for its next dividend.Comerica Announces Upcoming Dividend Payment

Comerica Announces Upcoming Dividend Payment

Comerica (NYSE: CMA) is set to distribute a dividend to its shareholders in the coming days. The ex-dividend date falls on June 14th, indicating that investors must own the stock by the end of trading on June 13th to be eligible for the dividend payment. The dividend will amount to $0.71 per share and will be paid out on July 1st.

Dividend Yield and Affordability

Based on the company’s recent dividend payments, Comerica’s stock currently offers a rolling yield of approximately 5.9% at a current share price of $48.05. Last year, the company paid out a total of $2.84 per share in dividends. While a dividend payout is often seen as a desirable feature, it is crucial to assess whether the company can sustain the dividend without compromising its financial health. Comerica paid out 56% of its earnings to investors last year, which is a normal level for many companies.

Profitability and Dividend Growth

However, Comerica has witnessed a decline in its earnings per share by 7.2% per year over the past five years. This raises concerns about the sustainability of the dividend since the smaller the earnings base, the less money is available for dividend payments. On the other hand, Comerica has exhibited strong dividend growth, with an average annual growth rate of 15% over the past decade. This suggests that the company has been able to generate sufficient cash flow to support both dividend payments and earnings growth.

Assessment and Conclusion

While Comerica offers a high dividend yield, investors should be cautious given the company’s declining earnings. The dividend payout ratio of 56% is not overly concerning, but the combination of falling profits and a high payout ratio may pose risks to the sustainability of the dividend in the long run. Potential investors are encouraged to further evaluate the company’s financial health and growth prospects before making any investment decisions based solely on the dividend.

Consider Key Factors Before Investing in Comerica Incorporated for Next Dividend

Analysts urge caution for investors considering Comerica Incorporated (NYSE: CMA) for its upcoming dividend. Before committing, they recommend conducting thorough checks to assess potential risks and rewards.

Dividend Yield and Payout Ratio:

Comerica’s dividend yield, at around 3.5%, is higher than the industry average. However, investors should examine the company’s payout ratio, which measures the percentage of earnings paid out as dividends. A high payout ratio may indicate limited funds for future growth or dividend increases.

Financial Performance:

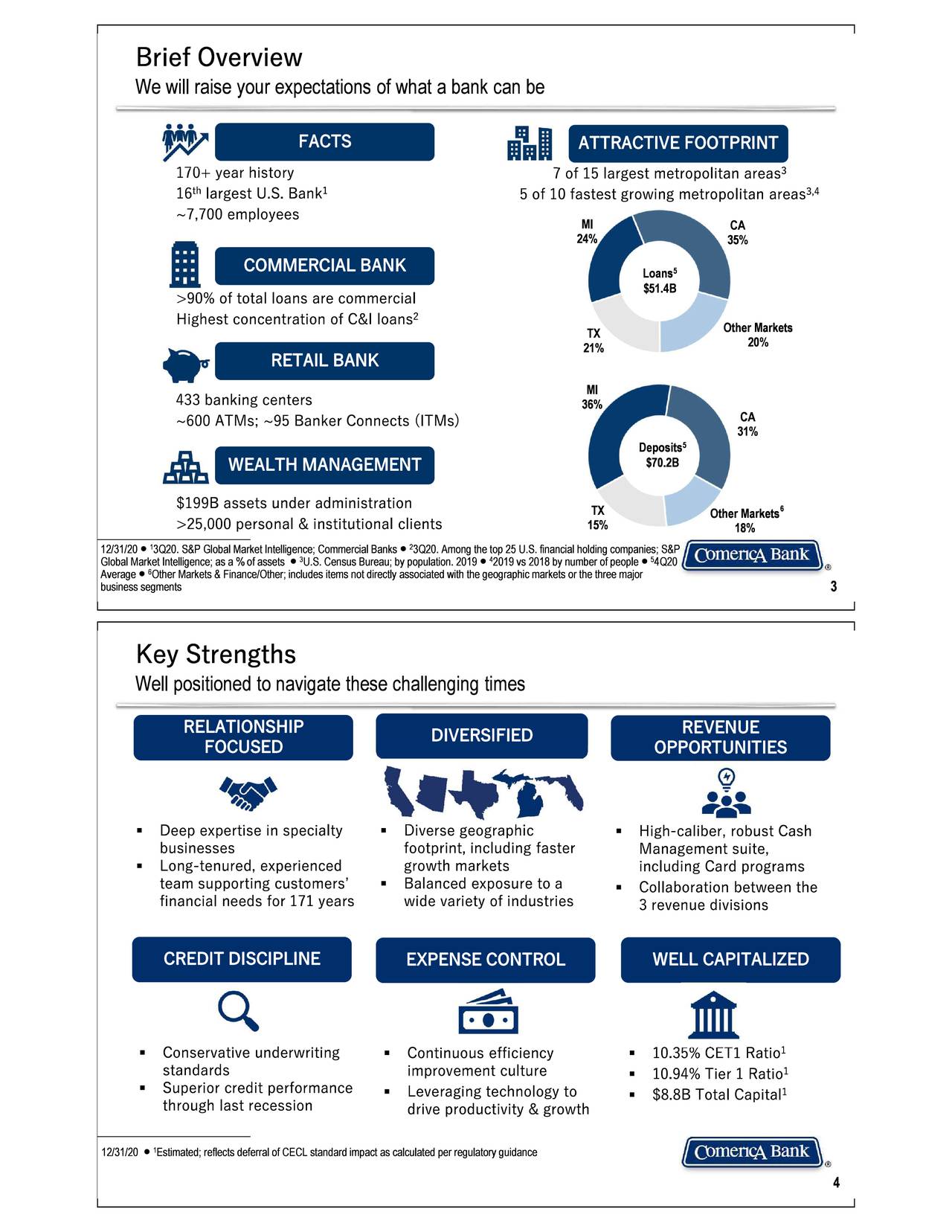

Scrutinize Comerica’s financial performance to gauge its ability to sustain dividend payments. Consider factors such as revenue growth, net income, and return on equity. A declining trend in these metrics could raise concerns about the company’s long-term health.

Interest Rate Sensitivity:

Comerica’s revenue and earnings can be impacted by interest rate fluctuations. Rising interest rates may boost its net interest margin, but falling rates could have an adverse effect. Investors should assess the company’s sensitivity to interest rate changes.

Competition and Market Dynamics:

Comerica operates in a competitive banking industry. Analyze its market position, customer base, and product offerings. Determine if the company has a strong competitive advantage and the ability to defend its market share.

Analysts’ Consensus:

Consult with analysts’ research reports and consensus estimates. Gather insights into their views on Comerica’s dividend sustainability, financial trajectory, and industry outlook. Analyst opinions can provide valuable perspectives.

Investment Strategy:

Based on the checks conducted above, investors should tailor their investment strategy for Comerica. They may consider holding the stock for long-term dividends, but also allocate funds to other investments to diversify their portfolio and mitigate risk. By conducting these checks, investors can make informed decisions and avoid potential pitfalls when investing in Comerica Incorporated for its next dividend.

+for+its+next+dividend+without+doing+these+checks&simid=608028436287739817&FORM=IRPRST&ck=456A9A30D8C7885CD24151F837EDD248&selectedIndex=1&itb=0)

+for+its+next+dividend+without+doing+these+checks&simid=607992229702743044&FORM=IRPRST&ck=605BECD8B33402A1E6B1FEA7DE7B507D&selectedIndex=20&itb=0)