Unlock Passive Income with These Top 2 High-Yield Dividend Stocks

In today’s volatile market, it’s more crucial than ever to seek out investments that provide a steady stream of income. High-yield dividend stocks can offer just that, providing investors with a reliable source of passive income while potentially mitigating market fluctuations. Here are our top 2 picks for high-yield dividend stocks to buy now:

1. Realty Income Corporation (O)

*

Dividend yield:

4.3% *

Sector:

Real estate investment trust (REIT) Realty Income is a leading REIT that owns and leases over 11,000 single-tenant commercial properties in the United States and internationally. The company has a strong track record of consistent dividend growth, having increased its dividend for 100 consecutive quarters. Realty Income’s diversified portfolio and long-term lease agreements provide a stable source of rental income, making it a reliable dividend payer.

2. AT&T Inc. (T)

*

Dividend yield:

5.1% *

Sector:

Telecommunications AT&T is a global telecommunications giant that provides a range of services, including wireless, broadband, and streaming. The company has a massive customer base and a strong brand reputation. While AT&T’s dividend payout ratio is above 100%, the company’s large scale and cash flow from its core business provide comfort to investors that the dividend is sustainable.

Why Invest in High-Yield Dividend Stocks Now?

*

Passive income:

High-yield dividend stocks provide a regular stream of income, even in down markets. *

Inflation hedge:

Dividends tend to rise with inflation, helping to preserve the purchasing power of your investments. *

Capital appreciation:

While high-yield dividend stocks may offer lower potential for capital appreciation than growth stocks, they can still provide steady returns over the long term.

Risks to Consider:

*

Interest rate sensitivity:

Rising interest rates can make dividend stocks less attractive compared to other investments. *

Dividend cuts:

Companies can cut or suspend dividends in response to economic downturns or other challenges. *

Unsustainable payout ratios:

High dividend payout ratios can indicate a company’s inability to generate sufficient cash flow to support the dividend.

Due Diligence:

Before investing in any high-yield dividend stock, it’s essential to conduct thorough due diligence. Consider the following factors: * Financial stability of the company * Dividend history and sustainability * Industry outlook and competitive landscape * Payout ratio and cash flow coverage By carefully selecting high-yield dividend stocks that meet these criteria, investors can potentially generate a steady stream of passive income while mitigating some of the risks associated with dividend investing.Coastguard Inquiry Leads to Unexpected Discovery

Coastguard Inquiry Leads to Unexpected Discovery

On the afternoon of a recent day, the Southend Coastguard was alerted to a person spotted in the water near the pier. The Coastguard team, along with the RNLI Southend and Coastguard Canvey, responded promptly to the report. However, upon arriving at the scene, the officers were informed that the person in question had been located. The Maritime Rescue Co-Ordination Center in Dover requested a search of the area, but it was later revealed that the individual had wandered off and suffered minor injuries from oyster beds. They subsequently reported to a police unit on Marine Parade. A Coast Guard spokesperson stated, “This proved to be a false alarm with good intentions. If you ever witness someone in distress near the coast, do not hesitate to call 999 and request the Coastguard. Your actions could save a life.” Despite the false alarm, the incident highlighted the importance of swift response to reports of people in distress at sea. The Coastguard urged the public to report any suspicious activity or concerns promptly, as every minute could count.

Top 2 High-Yield Dividend Stocks to Invest In

Amidst fluctuating market conditions, dividend stocks offer a steady stream of income for investors. Here are two high-yield dividend stocks that stand out as attractive investment opportunities:

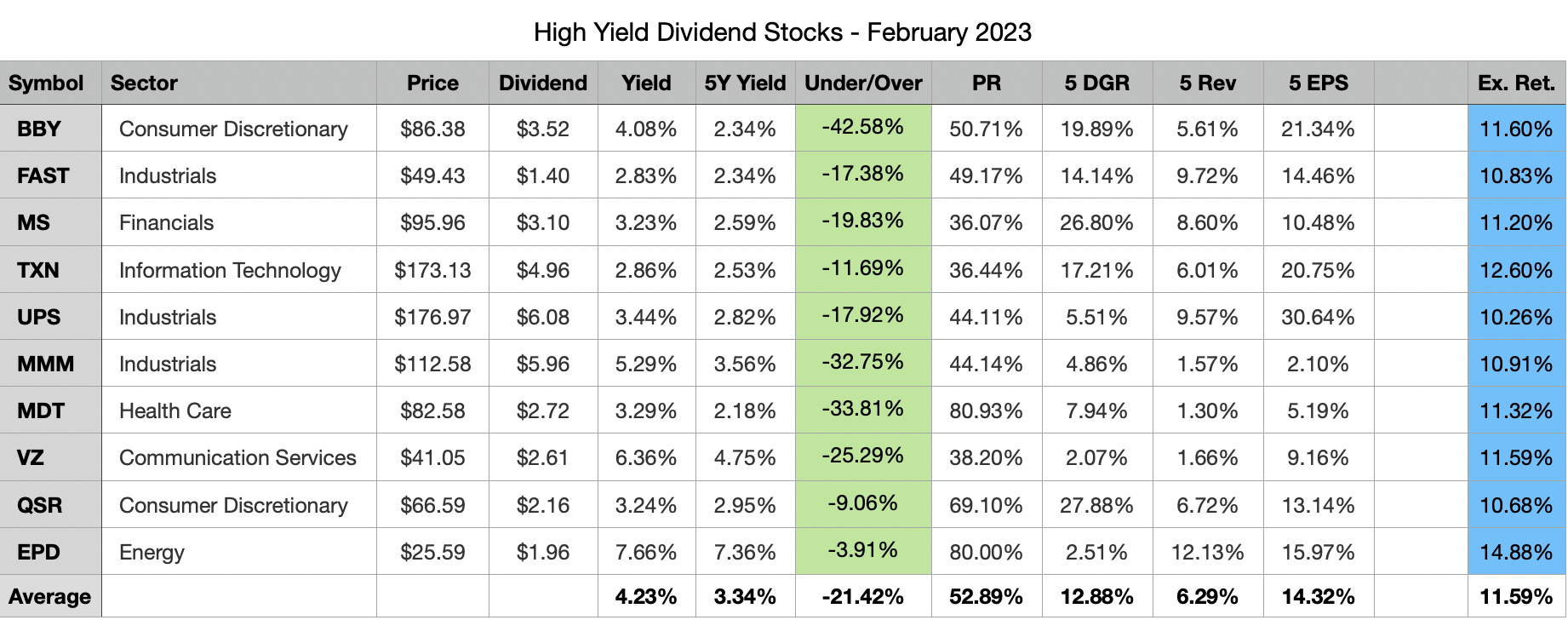

1. Enterprise Products Partners (EPD)

Enterprise Products Partners is a midstream energy company that transports, processes, and stores natural gas, crude oil, and refined products. Its operations span across the United States and Canada. *

Dividend Yield:

7.91% *

Dividend Frequency:

Quarterly *

Payout Ratio:

60% EPD’s strong cash flows from its long-term contracts and diversified asset portfolio support its high dividend yield. The company has a history of consistently increasing its dividend, with a compound annual growth rate of 9% over the past 20 years.

2. Altria Group (MO)

Altria Group is a leading tobacco and cigarette producer. Despite declining smoking rates, the company maintains a strong position in the market due to its well-known brands such as Marlboro and Camel. *

Dividend Yield:

8.68% *

Dividend Frequency:

Quarterly *

Payout Ratio:

87% Altria’s consistent cash flow and defensive business model have allowed it to sustain its high dividend yield. The company has a history of annual dividend increases since its spin-off from Philip Morris International in 2008. These two dividend stocks offer attractive yields and have demonstrated a commitment to rewarding shareholders. While dividend yields can fluctuate, they provide investors with a potential source of income and potential for appreciation over the long term.

![]()