.2+ Artificial Intelligence (AI) ETFs: Long-Term Investments in the Future of Technology

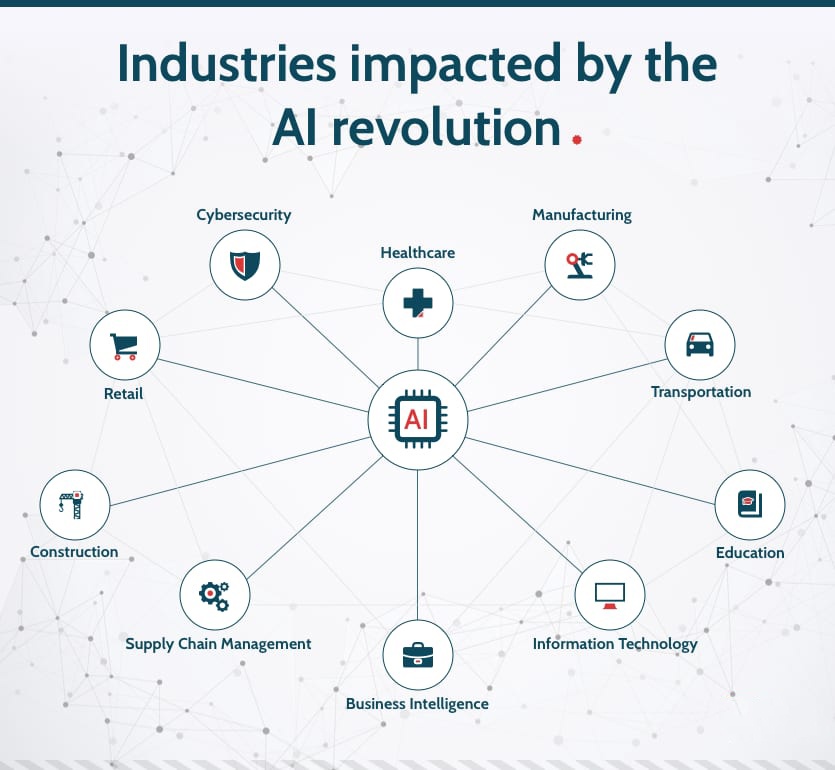

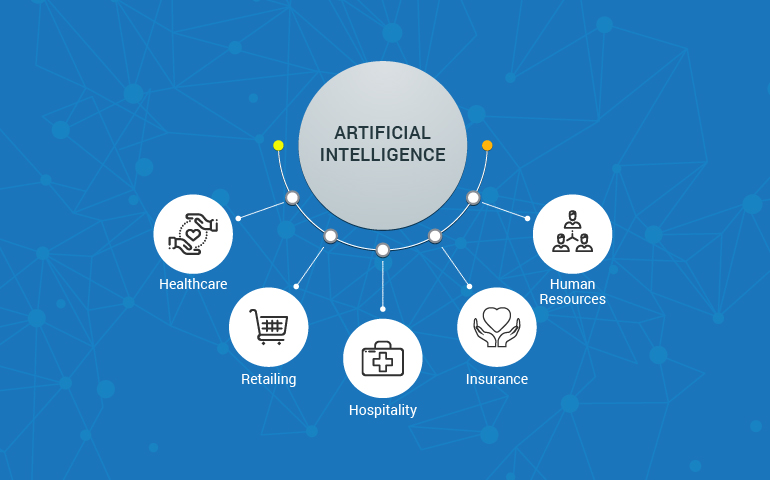

Artificial intelligence (AI) is rapidly transforming our world, revolutionizing industries and creating vast opportunities for investors. Exchange-traded funds (ETFs) provide a convenient and diversified way to gain exposure to the AI sector, allowing investors to hold these investments for decades to harness the long-term growth potential of this transformative technology.

1. ARK Innovation ETF (ARKK)

This actively managed ETF from ARK Invest focuses on disruptive innovation, including AI, robotics, and biotechnology. ARKK has a large allocation to AI-related companies, such as Tesla, Crispr Therapeutics, and Nvidia. With its forward-looking investment approach, it is suitable for investors seeking a high-growth exposure to AI.

2. iShares Exponential Technologies ETF (XT)

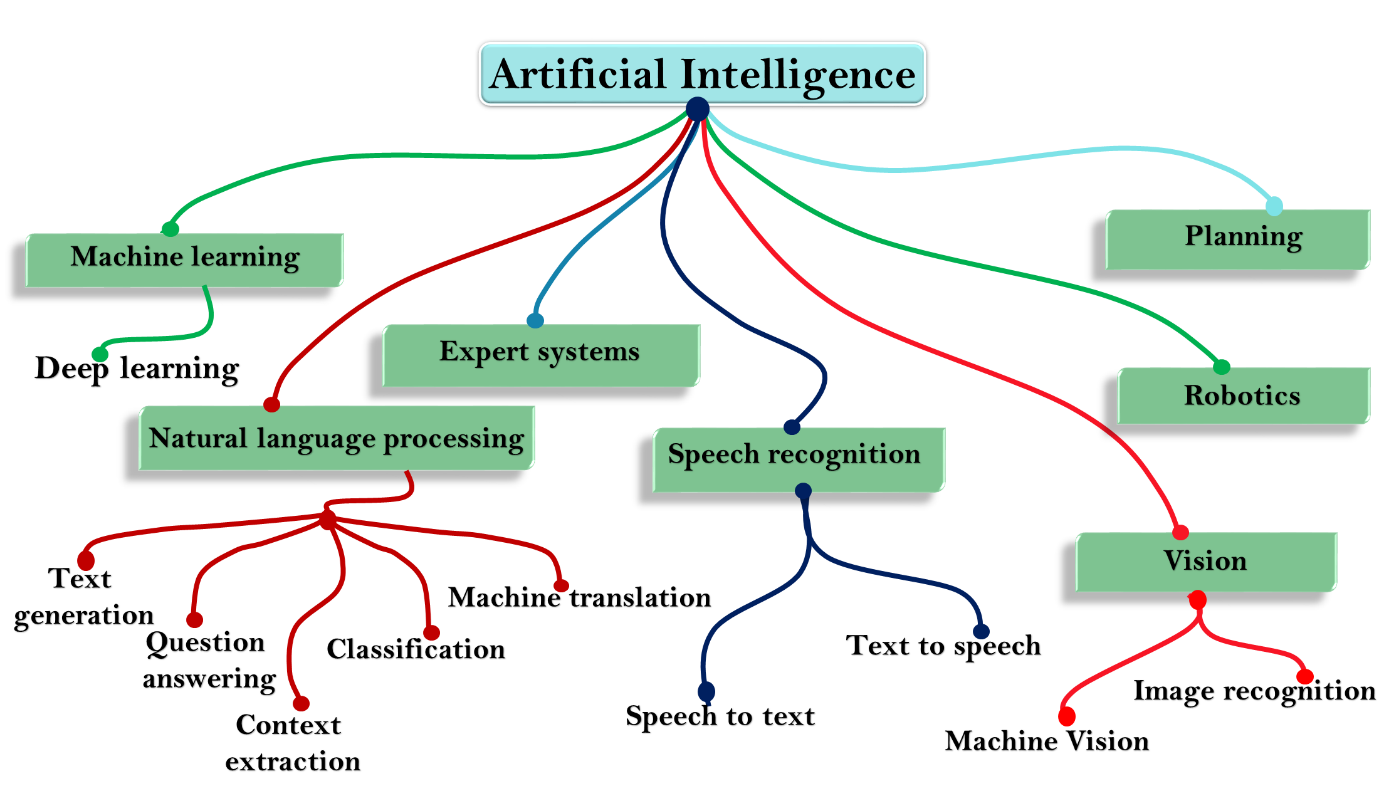

XT tracks the NASDAQ CTA Artificial Intelligence and Robotics Index, which comprises companies primarily involved in AI, machine learning, and robotics. It offers a broader exposure to the AI sector than ARKK, with holdings including Google, Microsoft, and Intel. Its diverse portfolio makes it a more conservative option for long-term investors.

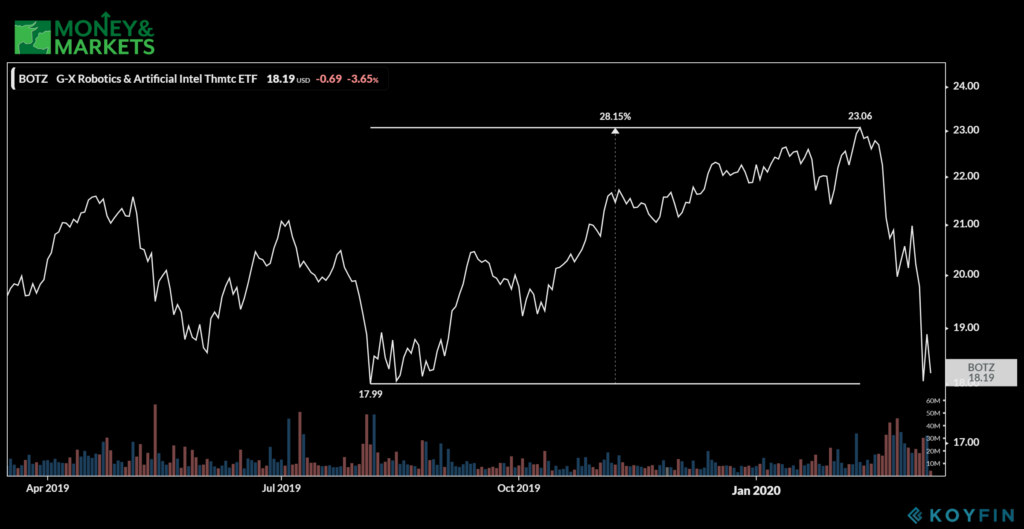

3. Global X Robotics & Artificial Intelligence ETF (BOTZ)

BOTZ invests in companies that develop and deploy AI technologies in various applications, from healthcare to manufacturing. Its portfolio includes companies such as Amazon, Apple, and Honeywell. By focusing on robotics and AI, it provides a targeted exposure to the intersection of these two rapidly advancing fields.

4. Fidelity MSCI Artificial Intelligence ETF (AI)

AI tracks the MSCI World Artificial Intelligence Index, which includes companies that derive a significant portion of their revenue from AI-related products and services. Its holdings span geographical regions and industries, offering a globally diversified exposure to AI innovation.

5. WisdomTree Artificial Intelligence & Innovation Fund (WTAI)

WTAI invests in companies that are developing and using AI to solve real-world problems. Its portfolio includes companies such as Lockheed Martin, Siemens, and IBM. It focuses on companies that are poised to benefit from the increasing adoption of AI across industries.

Benefits of Holding AI ETFs for Decades:

*

Long-term growth potential:

AI is a revolutionary technology that is expected to have a transformative impact on society and the global economy. By holding AI ETFs for decades, investors can capture the long-term growth potential of this emerging sector. *

Diversification:

AI ETFs provide diversification across multiple AI-related companies, reducing the risk associated with investing in individual companies. *

Access to innovation:

ETFs offer investors access to the latest AI innovations and companies, enabling them to participate in the advancement of this technology.

Conclusion:

AI ETFs provide an accessible and diversified way for investors to gain exposure to the transformative potential of artificial intelligence. By holding these ETFs for decades, investors can harness the long-term growth potential of AI and benefit from the technological advancements that are shaping our future.Exchange-Traded Funds (ETFs) for Investing in Artificial Intelligence (AI)

Exchange-Traded Funds (ETFs) for Investing in Artificial Intelligence (AI)

As the hype around AI continues to grow, investors seeking long-term exposure may consider ETFs that track this rapidly evolving sector. Here are two potential options:

Invesco QQQ Trust (QQQ)

* Not directly focused on AI, but its top holdings (e.g., Microsoft, Nvidia, Amazon, Meta Platforms) are major players in the AI space. * Proven track record of outperforming the broader market over the past decade. * Diversified portfolio with exposure to both large-cap tech companies and growth sectors like AI.

Roundhill Generative AI & Technology ETF (CHAT)

* Actively managed fund that targets investments specifically in generative AI and related technologies. * Focus on companies with exposure to AI capabilities such as natural language processing, image generation, and machine learning. * Higher risk due to its concentrated portfolio and active management approach.

Considerations

* Both ETFs provide diversification benefits by investing in multiple companies. * The high growth potential of AI could lead to strong returns over the long term. * However, AI is a rapidly evolving field, and investing in ETFs involves risks such as market volatility and changes in industry trends.

Recommendation from Motley Fool

According to Motley Fool, Invesco QQQ Trust (QQQ) may not currently be among the 10 best stocks for investors to buy. They recommend considering their stock advisor service, which has identified companies with the potential for significant returns in the coming years.

Artificial Intelligence ETFs: Long-Term Investments for Technological Advancements

The burgeoning field of artificial intelligence (AI) holds immense potential for shaping our future. Investors seeking exposure to this transformative technology can consider investing in AI-themed exchange-traded funds (ETFs). These ETFs provide diversification and offer opportunities for long-term returns.

Two Recommended AI ETFs for Decades-Long Holdings:

1. Global X Robotics & Artificial Intelligence ETF (BOTZ):

* Tracks companies involved in robotics, AI, and automation * Top holdings include NVIDIA, Qualcomm, and Tesla * High exposure to growth stocks, including Tesla * Annual expense ratio: 0.68%

2. ARK Innovation ETF (ARKK):

* Focuses on disruptive technology companies, including AI, genomics, and blockchain * Top holdings include Tesla, Roku, and Zoom * More speculative and volatile than BOTZ * Annual expense ratio: 0.75%

Why Invest in AI ETFs for the Long Term?

*

Growing Adoption of AI:

AI is permeating various industries, from healthcare to finance, driving demand for AI-related products and services. *

Technological Advancements:

The field of AI is rapidly evolving, with constant innovation and advancements, creating future growth opportunities. *

Long-Term Trend:

AI is expected to play a crucial role in shaping the future economy and society, making it a promising investment for decades to come. However, it’s important to note that these ETFs are subject to market volatility and may experience downturns. Investors should carefully assess their risk tolerance and investment goals before investing in AI ETFs. By holding these ETFs over the long term, investors can potentially capitalize on the transformative potential of artificial intelligence without incurring excessive risk.

+ETFs+You+Can+Buy+Now+and+Hold+for+Decades&simid=607995317794597381&FORM=IRPRST&ck=5688EC2DD3C5728F7A65373634D05E17&selectedIndex=10&itb=0)